Hiring Trends Index: a look at the recruitment landscape of Q1 2021

Jump to the latest Hiring Trends Index (Q3 edition)

The latest Hiring Trends Index launched on 19th October 2021. Take a look at the most up-to-date findings.

Hiring Trends Index Q1 2021: Key findings at a glance

The first three months of 2021 saw notable positives for the recruitment landscape, with 26% of businesses increasing their hiring. In particular, media, marketing, advertising, PR & sales, health & medical services and IT & telecoms increased their hiring above the average seen across the wider market[1]. However, 23% of businesses paused recruitment at some point in the last three months, reflecting that the market is still a little rocky. The Prime Minister’s roadmap has enabled employers to build confidence in the state of the economy and recruitment market, which for many has meant they can now finalise plans to get back to business.Top takeaways from the Hiring Trends Index Q1

- A quarter (24%) have more certainty around business planning, following the Government announcing their Covid-19 roadmap.

- A quarter (26%) of businesses increased recruitment in the last three months.

- A quarter (24%) plan on increasing recruitment in Q2 and only 18% don’t expect to recruit at all.

The last three months

Hiring continued to differ across sectors from mid-December 2020 to mid-March 2021. Overall, over a quarter (26%) of UK businesses accelerated their recruitment. IT and tech roles (19%) and operations roles (17%) were in particular demand, followed by sales (14%), general management (13%) and finance (12%). 16

However, just under a quarter (23%) of businesses had to pause their recruitment during the last three months and 7% decreased it – while 37% didn’t recruit at all.

Despite the continuation of furlough, 17% of businesses have had to make redundancies in recent months, but more positively, 23% saw no changes to their workforce (including the size of the workforce, hours worked or any other changes). Meanwhile, 21% restructured a team or department within their business, and 22% reduced working hours, potentially due to a lack of demand. However, 17% of businesses saw an increase in hours.

16

However, just under a quarter (23%) of businesses had to pause their recruitment during the last three months and 7% decreased it – while 37% didn’t recruit at all.

Despite the continuation of furlough, 17% of businesses have had to make redundancies in recent months, but more positively, 23% saw no changes to their workforce (including the size of the workforce, hours worked or any other changes). Meanwhile, 21% restructured a team or department within their business, and 22% reduced working hours, potentially due to a lack of demand. However, 17% of businesses saw an increase in hours.

Sectors experiencing an increase in total working hours:

- Transport & distribution 29%

- IT & telecoms 24%

- Medical & health services 20%

Sectors experiencing a decrease in total working hours:

- Hospitality & leisure 45%

- Retail 34%

- Manufacturing 29%

Prime Minister’s roadmap boosts business confidence

The Prime Minister’s roadmap out of Covid and planned dates to remove restrictions has given the majority of UK businesses a much-needed boost to their confidence. A quarter (24%) of businesses say they now have more certainty surrounding business planning. Confidence is even higher for retail (34%), hospitality & leisure (33%) and education (30%). The future looks bright for a further 22% of employers, who say the UK government’s roadmap has given them more confidence in their business’ future. An even higher number (32%) of hospitality & leisure businesses and retailers report renewed confidence in their future.

The roadmap has enabled 15% of businesses to finalise their future ways of working, with nearly a fifth (19%) of HR Decision Makers cementing their plans to reopen offices and 18% booking in plans for in-person businesses activities.

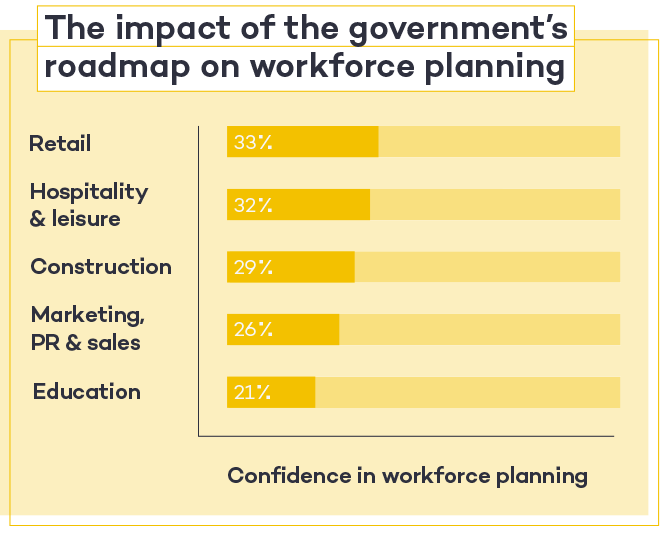

When it comes to workforce planning, there is a similar level of optimism, with 21% of HR Decision Makers reporting they now have more certainty in this area, as a result of the UK government’s roadmap detailing the easing of Covid-19 restrictions. Retail and hospitality & leisure again report the highest levels of certainty (33% and 32%), followed by construction at 29% and media, marketing, advertising, PR & sales at 26%.

The future looks bright for a further 22% of employers, who say the UK government’s roadmap has given them more confidence in their business’ future. An even higher number (32%) of hospitality & leisure businesses and retailers report renewed confidence in their future.

The roadmap has enabled 15% of businesses to finalise their future ways of working, with nearly a fifth (19%) of HR Decision Makers cementing their plans to reopen offices and 18% booking in plans for in-person businesses activities.

When it comes to workforce planning, there is a similar level of optimism, with 21% of HR Decision Makers reporting they now have more certainty in this area, as a result of the UK government’s roadmap detailing the easing of Covid-19 restrictions. Retail and hospitality & leisure again report the highest levels of certainty (33% and 32%), followed by construction at 29% and media, marketing, advertising, PR & sales at 26%.

Media, Marketing, Advertising, PR & sales is summarised as Marketing, PR & sales in the above.

However, it’s still a mixed bag of opinions even within the same industry, as the factors of location and size of business also play a role in how impactful the government’s roadmap is for an individual business. For example, 14% of hospitality & leisure businesses have experienced more uncertainty surrounding workforce planning, followed by, perhaps surprisingly, 12% of transport & distribution employers. Media, marketing, advertising, PR & sales, along with IT & telecoms and retailers are the other sectors most likely to have reported an increase in uncertainty (11% of each).

As of April 12th, we saw the re-opening of non-essential retail and outdoor hospitality, alongside gyms and personal care businesses including hairdressers. Many businesses also have the 17th May earmarked for a surge in demand, with restrictions on outdoor social contact expected to be loosened again, and indoor hospitality will reopen, along with sporting events.

Medical & health services (28%), manufacturing (28%) and education (25%) are the sectors most likely to report seeing no impact off the back of the UK government’s roadmap, which is unsurprising given the number of key workers these sectors employ.

22% of employers are more confident in their business’ future following the government’s roadmap, and it’s a positive sign that this is similar across small, medium and larger businesses. Employers based in Yorkshire and the Humber are feeling the most optimistic about their business’ future, at 27%, followed by those in the North West (24%) and London (23%).

Media, Marketing, Advertising, PR & sales is summarised as Marketing, PR & sales in the above.

However, it’s still a mixed bag of opinions even within the same industry, as the factors of location and size of business also play a role in how impactful the government’s roadmap is for an individual business. For example, 14% of hospitality & leisure businesses have experienced more uncertainty surrounding workforce planning, followed by, perhaps surprisingly, 12% of transport & distribution employers. Media, marketing, advertising, PR & sales, along with IT & telecoms and retailers are the other sectors most likely to have reported an increase in uncertainty (11% of each).

As of April 12th, we saw the re-opening of non-essential retail and outdoor hospitality, alongside gyms and personal care businesses including hairdressers. Many businesses also have the 17th May earmarked for a surge in demand, with restrictions on outdoor social contact expected to be loosened again, and indoor hospitality will reopen, along with sporting events.

Medical & health services (28%), manufacturing (28%) and education (25%) are the sectors most likely to report seeing no impact off the back of the UK government’s roadmap, which is unsurprising given the number of key workers these sectors employ.

22% of employers are more confident in their business’ future following the government’s roadmap, and it’s a positive sign that this is similar across small, medium and larger businesses. Employers based in Yorkshire and the Humber are feeling the most optimistic about their business’ future, at 27%, followed by those in the North West (24%) and London (23%).

What will the next three months bring for the UK’s recruitment market?

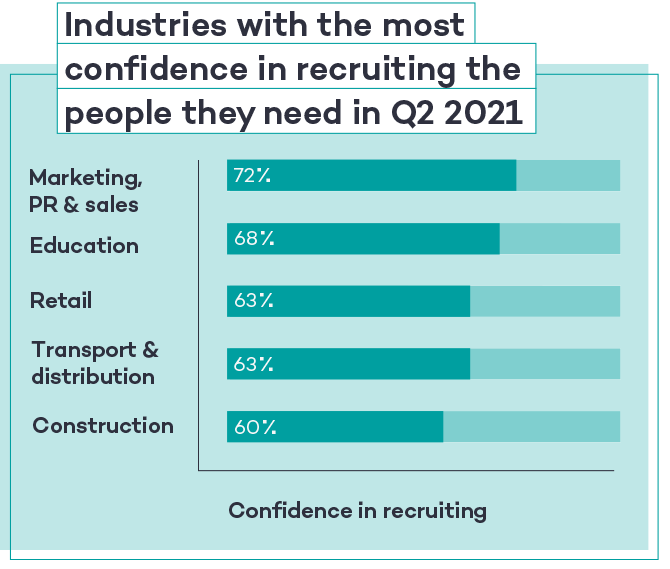

A quarter (24%) of HR Decision Makers expect to increase their recruitment in the second quarter of 2021 (i.e. before mid-June), showing that across the UK, employers are preparing to get back to business. Some businesses are anticipating greater demand for specialist roles, with a fifth planning to increase their spend in this area, compared to 9% increasing budgets for non-specialist roles. What’s more, the pandemic hasn’t brought innovation to a halt; 5% of businesses will experiment with new hiring models in Q2 to help them hire the people they need. Confidence in successfully filling vacancies in the next three months is reasonably strong overall, with over half (56%) of HR Decision Makers reporting at least a score of 6 when asked to rank their confidence on a scale of 0-10, with zero being not at all confident and 10 being entirely confident. While optimism is largely on the up across the market, almost a fifth (18%) of businesses don’t expect to recruit at all in the coming three months. This rises a little to 20% of legal employers and manufacturers, and falls the most for education (9%), transport & distribution and marketing, PR and sales (both 8%). Meanwhile, a fifth of businesses expect to pause recruitment at some point in the next three months, and 8% expecting to decrease it.

Large businesses (250+ employees) are twice as likely as small businesses to say they are entirely confident they can recruit the people their business needs in the next three months (16% versus 8%). Retail is the sector most likely to report being entirely confident in filling their vacancies in the next three months, at 19%, which shows the industry is optimistic about footfall returning to a more ‘normal’ level when restrictions ease.

Large businesses (250+ employees) are twice as likely as small businesses to say they are entirely confident they can recruit the people their business needs in the next three months (16% versus 8%). Retail is the sector most likely to report being entirely confident in filling their vacancies in the next three months, at 19%, which shows the industry is optimistic about footfall returning to a more ‘normal’ level when restrictions ease.

Media, Marketing, Advertising, PR & sales is summarised as Marketing, PR & sales in the above.

Media, Marketing, Advertising, PR & sales is summarised as Marketing, PR & sales in the above.About the research

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1001 HR decision makers. Fieldwork was undertaken between 11th – 23rd March 2021. The survey was carried out online.Media, marketing, advertising, PR & sales industries increased recruitment by 38%, Medical & health services industries increased recruitment by 32%, and IT & telecoms industries increase recruitment by 31%.

Responses from HR Decision makers within the Legal sector was 50 respondents, which cannot be considered a robust sample size in relation to other industries.

HR Decision Makers were asked to rank their confidence in recruiting the people they need in Q2 2021 using a scale of 0-10, where 0 was not at all confidence and 10 was entirely confident. This means a ranking of 6 and above is considered confident.

HR Decision Makers were asked to rank their confidence in recruiting the people they need in Q2 2021 using a scale of 0-10, where 0 was not at all confidence and 10 was entirely confident. This means a ranking of 6 and above is considered confident.

Receive the latest resources and advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events, and special offers from Totaljobs.