Hiring Trends Index: a look at the recruitment landscape of Q4 2021

Hiring Trends Index Q4 2021: Key findings at a glance

With the discovery of the Covid-19 variant known as Omicron towards the end of 2021, the UK has once again had to adapt to rising cases and the implications this has on our healthcare system. While the devolved nations of the UK have announced varying levels of restrictions, across the board people have been asked to work from home where possible and wear masks in indoor public spaces. As for the labour market, 38% of businesses increased their hiring in the last quarter of 2021, only lower than the level seen in Q3 (43%) in what is a typically quieter quarter for recruitment. In total, 77% of businesses surveyed recruited during this period. Beyond recruitment, businesses have been investing into their employee engagement strategies. Almost three quarters (69%) of HR Decision Makers reported an increased focus on staff wellbeing in 2021, with over a third (36%) expecting this to increase further in 2022 and a quarter expecting to have a similar level of activity to last year. While skill shortages remain the top challenge for businesses at a local level, there are also a range of macrotrends employers expect to impact the UK labour market this year.Top takeaways from the Hiring Trends Index Q4

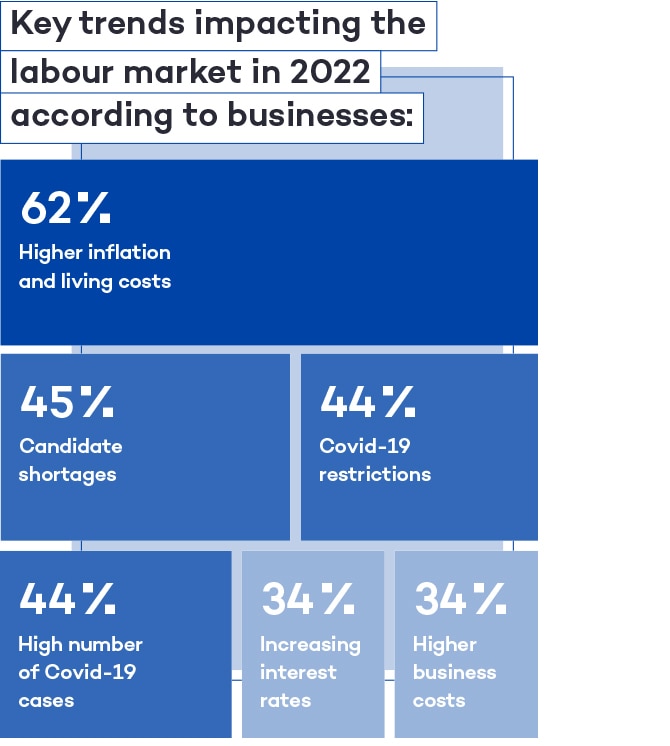

- Inflation and cost of living are expected to have greater impact on labour market than Covid-19 restrictions or case numbers in 2022, according to businesses.

- 38% of employers increased recruitment in Q4 2021, with a fifth (21%) expecting to increase hiring in the first quarter of 2022.

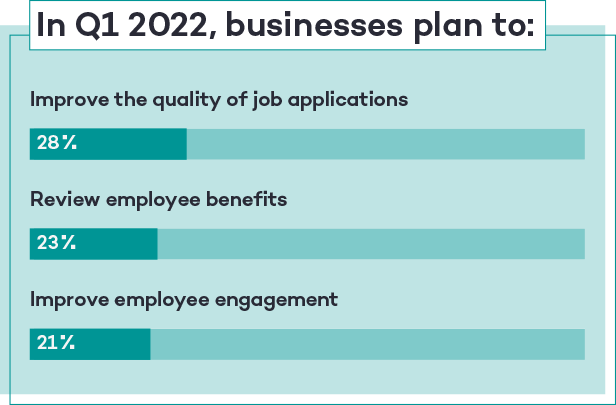

- Skill shortages look set to be the top challenge for businesses in Q1 (36%), topping the list for another quarter, while 28% of businesses looking to improve the quality of the job applications they receive before the end of March.

The last three months

The number of job vacancies in the UK between September to November 2021 continued to rise to a new record high. However, the rate of growth is slowing, with the latest ONS data (September to November 2021) showing that vacancies rose by 17.9%, compared to an 35.4% increase in the previous quarter. Hiring Trends Index data from Q4 2021 showed that 38% of businesses increased their recruitment, with 9% introducing a new hiring model. The industries that were the most likely to have increased their hiring were medical & health services (45%), transport & distribution (43%) and Legal (43%), reflecting a rise in demand. In Q4 2021, Operations (28%), sales (21%) and IT/tech (20%) roles were the most in-demand roles for employers, which has been the case consistently in HTI data across the year. Only 22% of businesses did not recruit at all in Q4 2021, the same figure reported in Q3. This highlights how many businesses are still searching for the people they need; in fact, only 16% of businesses reported that all of the vacancies they were advertising in Q4 have been successfully filled, pointing to a longer time to hire across the board. HR leaders estimate that their average time to hire in Q4 was nearly four and a half weeks (4.3 weeks). Compared to Q3, a larger number of businesses reported no change to their workforce at all (27% Q4 vs. 18% Q3), while just over a fifth (22%) restructured teams and 10% made redundancies, the same figure we saw in Q3 following end of the furlough scheme.

Industries reporting increased recruitment in Q4 2021

19Recruitment in Q1 2022

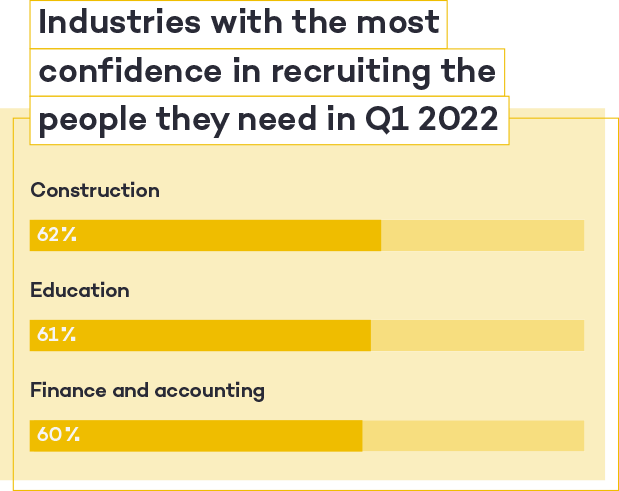

Over half (54%) of businesses are confident they will recruit the people they need in Q1 2022. Recruitment is set to ramp up for the start of 2022, with 21% of HR leaders planning to increase hiring and 15% set to increase spend on specialist roles.

With many businesses reporting that skills shortages will be their biggest challenge in the first quarter of 2022, 28% are looking to improve the quality of the job applications they receive. More focus will be placed on improving the applications received from external candidates (16%), while 12% are looking to do the same for candidates already in their business. It’s not just about quality of applications, for many businesses, they are prioritising quantity, as across the market candidate activity remains lower than employer demand – 15% of businesses want to increase the number of applications they receive.

Our HTI data shows that 15% of UK working-age adults are currently looking for a job (as of December 2021), and this figure rises to 21% of people who plan to look within the first quarter of 2022. Interestingly, 29% of UK workers revealed they looked at jobs in the last quarter of 2021 but did not apply, highlighting that a good amount of people currently in work are engaged with what other businesses could offer them in the new year.

With many businesses reporting that skills shortages will be their biggest challenge in the first quarter of 2022, 28% are looking to improve the quality of the job applications they receive. More focus will be placed on improving the applications received from external candidates (16%), while 12% are looking to do the same for candidates already in their business. It’s not just about quality of applications, for many businesses, they are prioritising quantity, as across the market candidate activity remains lower than employer demand – 15% of businesses want to increase the number of applications they receive.

Our HTI data shows that 15% of UK working-age adults are currently looking for a job (as of December 2021), and this figure rises to 21% of people who plan to look within the first quarter of 2022. Interestingly, 29% of UK workers revealed they looked at jobs in the last quarter of 2021 but did not apply, highlighting that a good amount of people currently in work are engaged with what other businesses could offer them in the new year.

Overall, 53% of working adults have no plans to look for a job this year which reflects the fact that the majority of workers are satisfied with their current job (62%). Only a fifth (19%) are not satisfied, while the rest of our sample were neutral.

A growing trend since the start of the pandemic has been the rise of the career change, and this looks set to continue, with 71% of jobseekers open to working in a different industry.

Overall, 53% of working adults have no plans to look for a job this year which reflects the fact that the majority of workers are satisfied with their current job (62%). Only a fifth (19%) are not satisfied, while the rest of our sample were neutral.

A growing trend since the start of the pandemic has been the rise of the career change, and this looks set to continue, with 71% of jobseekers open to working in a different industry.

Career motivations in 2022

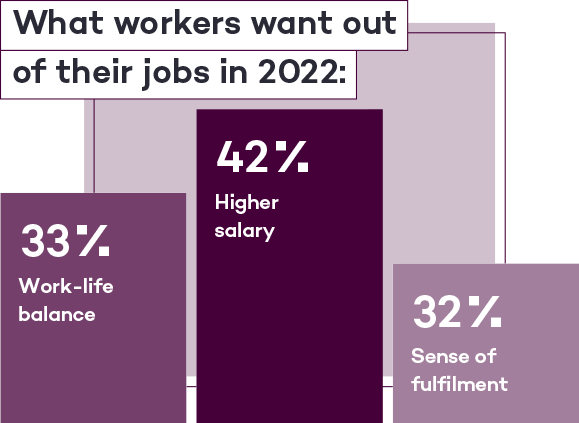

A range of motivations are driving UK working-age adults who are already job hunting or plan to within the next year (38% of the wider sample of 4,343 UK adults):- 34% career progression

- 31% to try something new

- 29% career development opportunities

- 28% higher salary

- 20% lack of recognition/reward in current role

A common thread throughout the pandemic was how well looked after staff felt. For some, this is an area they want to see improved in 2022, with 27% looking to feel more valued by their employer. This correlates with the over a fifth of people who have been motivated to look for a new job due to lack of recognition or reward in their current role. Day-to-day praise and appreciation can go a long way, especially while those who are traditionally based in offices are working from home.

Another narrative that has become a talking point since the beginning of the Covid-19 pandemic is what employers can do for their staff and prospective candidates; the value they are bringing to their teams, and how someone’s work complements their personal life. With this in mind, 19% of UK workers want a job that helps them meet personal milestones (such as buying a house).

Despite the candidate-led market, candidates seem uncertain about their chances of securing the job they want, with around a third reporting they’re confident, and the same amount reporting they’re not confident (32% vs. 34%).

A common thread throughout the pandemic was how well looked after staff felt. For some, this is an area they want to see improved in 2022, with 27% looking to feel more valued by their employer. This correlates with the over a fifth of people who have been motivated to look for a new job due to lack of recognition or reward in their current role. Day-to-day praise and appreciation can go a long way, especially while those who are traditionally based in offices are working from home.

Another narrative that has become a talking point since the beginning of the Covid-19 pandemic is what employers can do for their staff and prospective candidates; the value they are bringing to their teams, and how someone’s work complements their personal life. With this in mind, 19% of UK workers want a job that helps them meet personal milestones (such as buying a house).

Despite the candidate-led market, candidates seem uncertain about their chances of securing the job they want, with around a third reporting they’re confident, and the same amount reporting they’re not confident (32% vs. 34%).

Refining employee engagement strategies

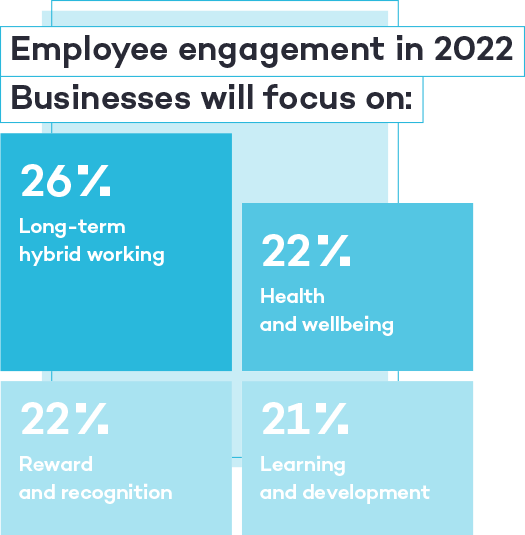

Many businesses continued to be focused on improving employee experience in Q4 2021, with 21% implementing practical ways to boost engagement, while a similar percentage (23%) were reviewing employee benefits and perks to make sure they were aligned with the needs of staff. Looking ahead to the rest of 2022, only 21% of businesses have no plans to change their current approach to employee engagement. The majority see an opportunity to reshape how they work and unlock more opportunities for their staff. A quarter (26%) of employers will move to a hybrid working model where time is split between the workplace and home, while 19% expect to be working from home more often – which could be a response to Government guidance or a longer-term commitment. Only 8% believe their staff will be working from home less often.

Recognising the hard work and dedication of staff is also high on the agenda, with nearly a quarter of businesses aiming to put greater focus on reward and recognition. One action businesses could take in this area is introducing bonuses or ad-hoc incentives like team lunches, vouchers or an early finish – all simple but effective approaches in boosting morale and making staff feel valued.

A small number (8%) of employers are looking to introduce fewer working hours or days across the board. The four-day working week has been trialled by many businesses in Europe and some UK businesses are taking similar steps. 16% also plan to introduce more team building activities in a bid to strengthen relationships between colleagues at the start of the year.

Wellness at work also emerged as a key trend over the last year, with almost three quarters (69%) of HR Decision Makers reporting an increased focus on staff wellbeing in 2021. It’s great to see over a third (36%) expect this to rise again in 2022. Only 22% said there was no greater focus on wellbeing last year and they don’t expect this to change.

With many people looking for career progression and personal development, it’s no surprise businesses are also zeroing in their focus on learning and development initiatives this year (21%).

Looking ahead to the rest of 2022, only 21% of businesses have no plans to change their current approach to employee engagement. The majority see an opportunity to reshape how they work and unlock more opportunities for their staff. A quarter (26%) of employers will move to a hybrid working model where time is split between the workplace and home, while 19% expect to be working from home more often – which could be a response to Government guidance or a longer-term commitment. Only 8% believe their staff will be working from home less often.

Recognising the hard work and dedication of staff is also high on the agenda, with nearly a quarter of businesses aiming to put greater focus on reward and recognition. One action businesses could take in this area is introducing bonuses or ad-hoc incentives like team lunches, vouchers or an early finish – all simple but effective approaches in boosting morale and making staff feel valued.

A small number (8%) of employers are looking to introduce fewer working hours or days across the board. The four-day working week has been trialled by many businesses in Europe and some UK businesses are taking similar steps. 16% also plan to introduce more team building activities in a bid to strengthen relationships between colleagues at the start of the year.

Wellness at work also emerged as a key trend over the last year, with almost three quarters (69%) of HR Decision Makers reporting an increased focus on staff wellbeing in 2021. It’s great to see over a third (36%) expect this to rise again in 2022. Only 22% said there was no greater focus on wellbeing last year and they don’t expect this to change.

With many people looking for career progression and personal development, it’s no surprise businesses are also zeroing in their focus on learning and development initiatives this year (21%).

Commitments to diversity, equity and inclusion

Many businesses talk about their values, which staff should embody in all of their work in order to succeed. But when it comes to the employee perspective, what do they want out of a company culture? 17% of businesses plan to implement strategies that create a more inclusive working culture in Q1. The vast majority (54%) of UK workers want to see a fair workplace, and one that is inclusive (51%) – meaning every member of staff feels they are respected and they can belong. These ideals are followed by an environment that is trusting (48%) and caring (44%). Taken together, it’s not surprising that collaboration is more important to most people than an ambitious or competitive culture (42%, 19% and 8% respectively). With COP26 taking place in 2021, this was a firm reminder of the state of the world’s climate. It’s great to see some businesses (15%) introducing or implementing their environmental or sustainability policies in Q1 2022 and we’d expect this figure to rise further over the coming year as more businesses make commitments. The starting point for any D,E& I activity is data. By understanding the diversity of current workforce and talent pools, employers can prioritise accordingly. However, HTI data shows that 49% of businesses don’t collect any diversity data on their current staff, while 54% of businesses don’t collect any diversity data on their candidates. Not all protected characteristics are reported on to the same extent:

Not all protected characteristics are reported on to the same extent:Boosting job satisfaction

Despite most UK workers feeling satisfied in their current role, retention remains a challenge for businesses. According to UK workers, the best parts of their job and the company they work for are flexible working (45%), working relationships (45%) and salary (33%). These were followed by:- 29% being recognised for job well done (e.g. praise from manager)

- 20% work perks/benefits

- 18% inclusive working culture

- 15% being rewarded for a job well done (e.g. early finishes, financial incentives)

- 15% career development opportunities

- 14% training opportunities

- 13% opportunities to take on take outside my remit

Business expectations and challenges for Q1 2022

The top challenges businesses anticipate for the first three months of 2022 are very similar to what we’ve seen in previous quarters, with skills shortages expected to have the biggest impact on businesses (36%) according to HR experts, followed by labour shortages (31%) and retaining staff (28%). Employers anticipate that skills shortages in technology & IT (23%) and Operations (21%) will be the most likely to negatively impact their wider business in 2022. Linked to candidate shortages is of course a lack of job applications, which 26% of businesses expect to impact them in the first quarter of 2022. For the first time, the Hiring Trends Index also asked businesses about staff absence, which a quarter (24%) had concerns about. Within the recruitment process, a lengthy time to hire is expected to be a hurdle this year, with 23% of businesses citing this. With salary always a significant factor in a person’s job satisfaction or motivation to search for a new job, some businesses expect to be impacted by an inability to offer competitive salaries (17%). This is no doubt linked to higher inflation – which is the top macrotrend businesses predict will influence the labour market in 2022, as well as a lack of business growth for some employers (reported by 18% of HR experts). Outside of their individual business, there are wider trends at play that, as always, influence the decisions employers make in response to the wider labour market. As mentioned, higher inflation or cost of living is expected to have the biggest impact on the labour market in 2022, according to 62% of businesses. This is higher than candidate shortages (45%), a high number of Covid cases (44%) and Covid-19 restrictions (44%). Other macrotrends businesses expect to impact the UK labour market in 2022:

Other macrotrends businesses expect to impact the UK labour market in 2022:

- 34% increasing interest rates

- 34% higher business costs

- 23% immigration policy

- 13% low productivity

- 12% environmental policy

- 15% changes to business tax

- 10% job automation

Totaljobs CEO, Jon Wilson, comments on the Hiring Trends Index Q4 edition

20

“Despite the disruption that Omicron absences are causing for some employers, our research shows that UK businesses expect higher inflation and the subsequent rising cost of living to have the biggest impact on the labour market in 2022. The record-breaking salaries that have already emerged in some sectors are a key indicator, with almost a fifth of businesses seeing the need to offer competitive pay as a challenge as we start the new year. Recruitment continues to be in full-swing, with a fifth of businesses planning to ramp up their recruitment in the first quarter of 2022. Meanwhile, thousands of candidates see this job market has swung in their favour, leading to a fifth of people planning to look for a new job before the end of March. For many, this shift in dynamics is a prompt to take the leap and change careers. For recruiters, considering the importance of transferable skills and using contextual recruitment techniques has never been more important to find and attract the best talent. As well as recruiting the people they need, employers continue to see retention as one of the top challenges their business could be impacted by in the first quarter of this year. However, 62% of UK workers are satisfied in their current role. Factors influencing this may include improvements to work-life balance, as well as employers putting more emphasis on the mental wellbeing of staff since the start of the pandemic. A significant 69% of employers heightened their focus on health and wellbeing last year, and over a third plan to invest further in this in 2022, which will help staff feel valued.”

Jon WilsonCEO at Totaljobs

About the research

The Totaljobs Hiring Trends Index is a quarterly deep-dive into the trends that are shaping businesses now, and in the months and years to come. Our inaugural Q1 research asked HR Decision Makers about their recruitment plans and experiences from mid-December 2020 to mid-March 2021, our Q2 edition covered April to June 2021, our Q3 edition reflects on shifts within recruitment from July to September 2021, and this January 2022 edition focuses on October-December 2021. HR Decision Maker sample All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1009 adults. Fieldwork was undertaken between 23rd December 2021 – 13th January 2022. The survey was carried out online. The figures have been weighted and are representative of British business size. UK adult sample All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 4343 adults. Fieldwork was undertaken between 23rd – 30th December 2021. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).HR Decision Makers were asked to rank their confidence in recruiting the people they need in Q1 2022 using a scale of 0-10, where 0 was not at all confidence and 10 was entirely confident. This means a ranking of 6 and above is considered confident.

Receive the latest resources and advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events, and special offers from Totaljobs.