Hiring Trends Index: a look at the recruitment landscape of Q4 2023

Table of Contents

- Market overview

- Top takeaways

- The last three months

- Recruitment in Q1 2024

- Challenges businesses expect in 2024

- Retention is at the forefront of business priorities

Totaljobs Hiring Trends Index provides a quarterly view of the UK job market and the recruitment trends shaping it. This edition looks at the final quarter of 2023 and draws on insights from HR decision-makers to understand the key challenges businesses are facing and their priorities in 2024.

The Q4 2023 edition of our Hiring Trends Index takes an in-depth look at insights from 1,012 HR decision-makers. This instalment focuses on the priorities and key challenges of businesses in terms of hiring and planning for 2024.

Hiring Trends Index – market overview

The UK labour market has been normalising, with vacancies falling rapidly throughout the year and more people looking for jobs. The number of vacancies now sits at 934,000, which is still higher than pre-pandemic levels. Although there was an uptick from 3.7% to 4.2% in the unemployment rate, it’s still relatively low.

Throughout the year, wages continued to compete with rising living costs. However, the annual wage growth has gradually slowed down by falling sharply from 7.3% to 6.5% in the latest period. This is good news for the Bank of England ahead of the new interest rate announcement on February 1st.

Despite rising wages, real pay has only increased 1.3% on the year and 4 in 10 adults (38%) still struggle to pay their energy bills and a third (33%) of adults paying rent find it difficult to afford.

Consequently, salaries are still front of mind for candidates. Our research shows that the primary reason behind resignations in Q4 2023 was seeking a higher salary (29%).

In the current economic climate, employers are looking for talent they can invest in and are planning to focus on retaining their workforce.

Top takeaways from the Hiring Trends Index Q4 2023

- 78% of businesses recruited in Q4 2023, a slight dip from 80% in Q3, but a figure consistent with the end of 2022.

- The number of vacancies fell under a million as the labour market cooled but remain higher than pre-pandemic levels.

- 29% of businesses increased their hiring in Q4 2023 (vs. 36% in Q3 2023). Over one in five (22%) businesses didn’t recruit, 18% paused their hiring and 7% decreased it.

- The average time to hire increased slightly from 6.1 weeks in Q3 to 6.2 weeks in Q4, positively below 6.4 weeks in Q4 2022.

- 58% of businesses are confident they will recruit the people they need in Q1 2024, rising from 53% reported in Q4 2022.

- Over a third (36%) of businesses say staying on top of operating costs is their number one challenge in 2024, followed by meeting candidate salary expectations (30%).

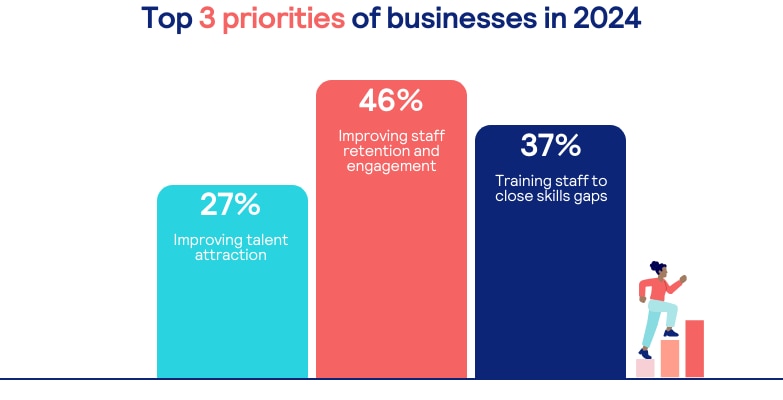

- The key people-priority for businesses in 2024 is improving staff retention and engagement (46%), as businesses turn their focus on maintaining their workforce.

The last three months

78% of businesses recruited in Q4 2023, which is consistent with the final quarter of 2022. Of those who hired, over a quarter (29%) increased their hiring and 18% paused it. As the current economic climate leads businesses to take stock, over a fifth (22%) made no changes to their hiring or workforce.

Some businesses (16%) hired temporary staff, freelancers, or contractors. Almost a fifth (21%) of businesses restructured a department, team, or wider business in Q4 2023, compared to 24% in Q3. Businesses are focusing on efficiency and need the right people to deliver on their 2024 plans. However, the rate of unemployment and vacancies point to a mismatch between available jobs and workers.

With employment already at high levels and economic inactivity causing the labour market to tighten, the search for talent took longer in the final quarter of 2023. The average time to hire slightly increased from 5.8 weeks in Q2 to 6.2 weeks in Q4.

Industries that were most likely to have increased recruitment in the final quarter of 2023 were; Real Estate (46%), Construction, Medical and Health Services, Education (all 39%), Legal (38%) and Finance and Accounting (35%).

Similar to Q3, businesses that recruited in Q4 2023 were most likely to recruit for Operations (26%), Technology/IT (24%), Sales (21%), and Customer Service (18%) roles.

Recruitment in Q1 2024

The majority (58%) of employers feel confident about finding the people they need in 2024.

Since the labour market started cooling down – especially in the second half of 2023 – business confidence in hiring has been going up. Yet, employers are wary of ongoing labour and skills shortages, and need to invest in people to meet customer demands.

27% of businesses plan to increase recruitment in Q1, with Transport and Distribution (40%), Real Estate, Medical and Health Services (both 36%) and Media/Marketing/PR/Sales (35%) being the most likely.

Of those who plan to hire in Q1, almost one in five (19%) plan to increase recruitment spend on specialist roles, with 10% investing more in non-specialist roles. 15% of businesses plan to increase recruitment for temporary staff or freelancers and 11% plan to take steps to make recruitment pools more diverse in Q1 2024.

Challenges businesses expect in 2024

Throughout 2023, businesses experienced decreased output and increased costs due to a challenging economic landscape.

Heading into 2024, the number one challenge for businesses in Q1 2024 is staying on top of operating costs such as workplace rent, payroll, and equipment. Over a third (36%) said this is a key area of concern, demonstrating the impact of rising living and property costs.

Following this challenge, 30% of businesses said they were concerned about meeting candidate salary expectations. Over the past year, wages have grown 6.5% due to the rising cost of living. Consequently, businesses offered higher wages to attract talent while being impacted by high inflation.

Another ongoing challenge for businesses is skills shortages, as 29% of businesses say they expect it to have an impact in 2024. Skills shortages are most prevalent in Manufacturing, Construction, Hospitality, IT, and Education sectors.

Our research shows that businesses are focusing on retaining their staff, as 29% also list it among their top 5 challenges for 2024. In fact, retention has surpassed filling vacancies (21%) on the list of business priorities for the first time.

Retention is at the forefront of business priorities

Businesses offered higher salaries across 2023 as the competition for talent heated up. The number one reason for staff resignations in the latest quarter was being offered a higher salary elsewhere (29%), followed by receiving a job offer from a different company or recruitment agency (21%).

A third of businesses (31%) reported no resignations, showing that an uncertain economy is making workers tentative to switch jobs and prefer stability. Similarly, fewer workers who resigned were willing to make a move due to a lack of career progression (14%) or wanting a career change (13%).

Considering these challenges, almost half (45%) of businesses say improving staff retention and engagement is the number one people-priority in 2024. This includes reviewing benefits and rewards, assessing training opportunities, investing in new technologies and offering flexible working.

Over a third (37%) of businesses are planning to invest in their workforce and train their staff to close skill gaps. However, businesses are likely to continue hiring, and over a quarter (27%) say improving talent attraction is on the list of priorities.

Most businesses have a plan to meet these priorities. However, over a fifth (21%) aren’t sure which actions to take, highlighting the uncertainty caused by continuing economic and labour market pressure.

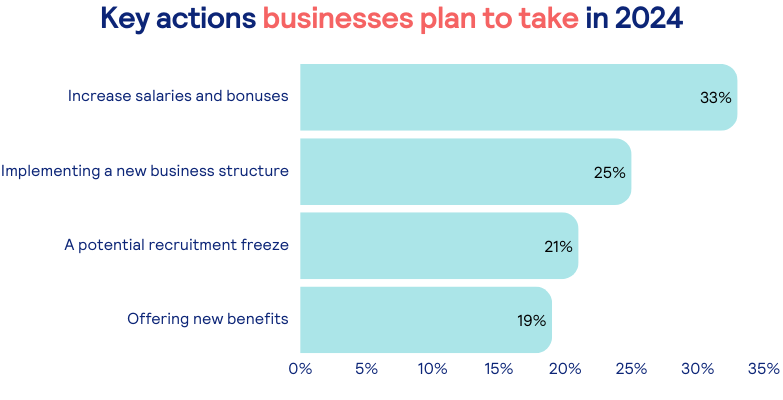

A third of businesses plan to increase salaries and bonuses (33%) at the start of 2024. Employers need to make sure that they develop a robust compensation policy and communicate it to staff. Conducting fair salary reviews and benchmarking salaries can help businesses do this more effectively.

A quarter (25%) of businesses said they aim to implement a new business structure in the first quarter of 2024. Businesses are looking to increase the efficiency of their operations and workforce planning is a significant part of this process.

Over a fifth (21%) of businesses are considering freezing recruitment in an uncertain economic landscape. Positively, approaching 1 in 5 (19%) plan to offer new benefits to attract and retain staff. We found that flexible hours, pension contributions and holiday allowance above what’s legally required, bonuses and hybrid working are the top 5 benefits UK workers look for.

According to Totaljobs’ data, jobseekers have expressed an increased interest in roles related to employee ‘reward’ and ‘retention’ in Q4 2023, with candidate searches up 85% on last year. Therefore, having a rewards strategy is key for businesses to retain their workforce. It can motivate staff and attract new talent can cut costs and increase productivity in 2024. Along with a rewards strategy, employers can invest in staff by developing a learning and development strategy which in turn would help plug skills gaps.

Whilst inflation has fallen significantly in the past six months, its effects continue to drive shifts in both wages and the labour market, but it’s essential to recognise that money isn’t the sole factor.

Recruitment and retention should go hand in hand, necessitating a review of engagement strategies and benchmarking salaries to achieve successful recruitment objectives this year.

Julius Probst, Labour Economist

Totaljobs – Your hiring solution partner

Work with an industry-leading hiring solutions provider that understands your challenges. Part of the global recruitment technology company The Stepstone Group, Totaljobs is a cutting-edge recruitment solutions partner whose goal is to find the right job for everyone. Find the right people for your business by reaching wider talent pools, increasing your brand’s visibility, and maximising your hiring budget.

HR decision-maker’s sample

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,012 HR decision-makers. Fieldwork was undertaken between 14th of December 2023 – 2nd of January 2024. The survey was carried out online. The figures have been weighted and are representative of business size.

Explore articles

Receive the latest recruitment resources and

advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events,

and special offers from Totaljobs.