UK industry salary and benefit trends for 2026

Table of Contents

- Key takeaways

- Market update

- Salary trends across 2025

- The importance of transparency

- Benefit trends across 2025

- Tips for employers

- About our research

UK Salary Trends Report 2026

Drawing from analysis of 21.6 million UK job positions across 22 industries and 21 cities, Totaljobs’ latest research uncovers the crucial salary and benefits trends shaping recruitment in 2026.

In this article, we’re taking a closer look at the findings and what they mean for employers navigating the UK labour market in 2026.

Key takeaways

- Pay remains the primary driver of job moves, with 51% of job switchers prioritising higher salaries and 41% of candidates looking or planning to look for a new role in 2026

- Despite 63% of workers receiving pay increases, 53% cut leisure spending and 32% cut essential spending

- High-paying sectors lead on satisfaction, with technology, banking & finance and construction delivering the strongest salary and benefits satisfaction

- Flexibility is non-negotiable for many workers, with 43% ruling out roles that lack flexible working options

- 80% of candidates avoid applying for roles that don’t include information around salary

- The gender pay gap is narrowing, but disparities persist across industries and in pay rise satisfaction

Market update: Economic conditions continue to shape pay and hiring

While inflation eased through 2025, its lasting effects continue to shape salaries and hiring. Employers remain cautious, with many reporting that they scaled back plans to increase pay (29%), bonuses (26%) and benefit expansions (23%) in response to economic pressures.

The factors businesses reported as having a significant impact on their compensation decisions in the last 12 months include:

- Inflation and cost-of-living pressures (58%)

- The overall economic outlook (57%)

- Company (54%) and employee (54%) performance

These economic factors continue to dictate both employer and candidate salary decisions. Candidates are looking for higher salaries in 2026, while employers are increasing pay. We see a 7.5% increase in advertised salaries, particularly for skilled talent in industries such as legal, banking & finance and technology.

Salary trends across 2025

Our findings show that the advertised average gross median salary in 2025 reached £33,526, representing 7.5% year-on-year growth.

London maintains its position at the top of the city rankings, with an advertised median salary of £40,000, but regional salary competition is intensifying, particularly in areas aligned with knowledge-based industries.

Oxford (£37,500) has leapfrogged Birmingham (£35,500) and Manchester (£33,800) in the rankings, reflecting its concentration of high-value roles in technology, life sciences and professional services, alongside sustained demand for specialist skills.

When it comes to individual industries, technology offers the highest advertised salaries (£48,600), followed by legal (£46,800) and banking & finance (£45,000).

However, a different picture emerges when looking at salary growth. The fastest-growing industries in 2025 were:

- Legal (10%)

- Property (9%)

- Sales (8%)

These increases reflect a combination of skills shortages, regulatory complexity and commercial pressure. In insurance and legal; the demand for compliance, risk and specialist advisory roles continues to outstrip supply. Meanwhile, in sales and property, businesses are prioritising roles that support growth in a challenging economic environment.

As in previous years, construction stands out as the only non-office-based sector among the highest-paying industries. Persistent labour shortages, an ageing workforce and sustained infrastructure demand continue to push wages upward, making construction one of the most competitive industries for employers.

Salary satisfaction

Despite the rising cost of living, employee salary satisfaction was healthy in the past year, reaching 78%.

This is likely influenced by employers taking action on pay:

- 63% of workers received a pay rise last year

- 74% were satisfied with the increase they received

Despite this improvement, many employees are still under financial strain. Over half (53%) cut back on leisure spending last year, 32% reduced spending on essentials and 29% reported relying on savings or loans.

As a result, salary remains the single most important factor when considering a new role for 80% of workers, while 51% cite higher pay as their main motivation for changing jobs. Looking ahead, 37% plan to earn more or ask for a pay rise in 2026.

41%

of candidates are looking for a new job or plan to in 2026

Industries with the highest salary satisfaction closely mirror the highest-paying sectors, with technology (94%) and banking & finance (85%) leading the way. Once again, construction (86%) stands out as a non-office-based sector, highlighting how demand-led wage growth can significantly boost employee sentiment.

UK Salary Trends Report 2026

The UK gender pay gap in 2025

While it remains a persistent issue, we continue to see signs of improvement in the UK gender pay gap, which, for full-time employees, dropped from 7.1% in April 2024 to 6.9% in the same period in 2025.

However, men also reported slightly higher pay rises at 4.5%, compared to 4% for women. As a result, women’s salary and pay rise satisfaction are slightly lower. Nearly half (48%) of women said their pay increase wasn’t enough to cover their current living expenses and two-fifths said the raise didn’t reflect their work performance and commitment (compared to 23% of men).

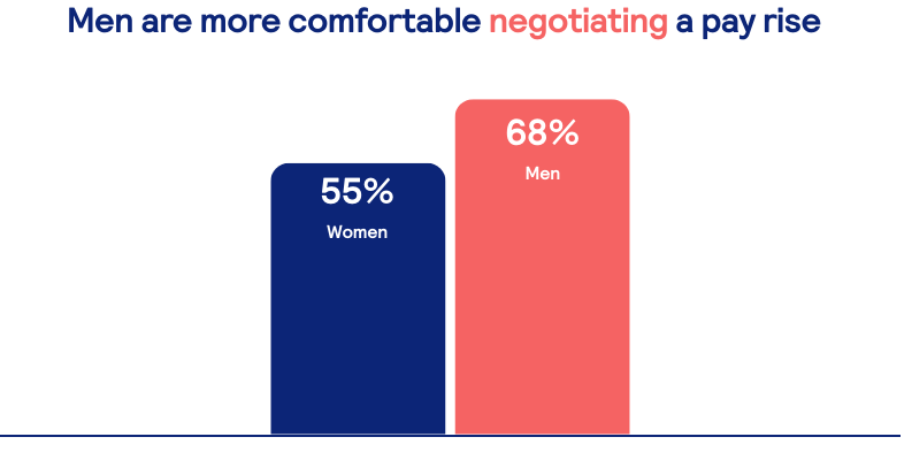

When it comes to negotiating, more men (68%) say they feel comfortable negotiating a pay rise compared to women (55%). However, with salary transparency becoming the norm, the gender pay gap and its impact on such disparities will likely subside.

When both full-time and part-time employees are included, the pay gap stands at 12.8%, down from 13.1% in April 2024, continuing a steady decline from 14.2% in 2023. This wider gap reflects the higher proportion of women in part-time roles, which typically offer lower hourly pay than full-time positions.

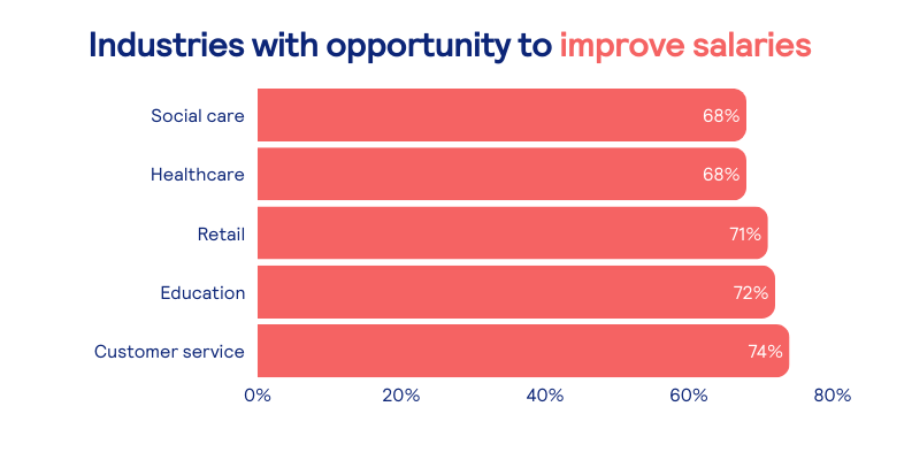

Despite overall progress, some industries still have more work to do. Those with the largest gender pay gaps include:

- Legal (19%)

- Education (15%)

- Skilled trades (14%)

- Healthcare (14%)

- Marketing & media (13%)

The importance of salary transparency

Our findings show that salary transparency is set to be a vital trend in 2026 and beyond, and one that employers can’t afford to ignore.

Salary transparency is vital to appealing to talent, with candidates increasingly expecting compensation details upfront:

- 83% say a lack of salary information negatively impacts their opinion of an organisation

- 80% avoid applying for roles with no salary information

- 89% are more likely to apply for jobs when a salary range is listed

From an employer perspective, 33% of recruiters say candidates drop out when salary expectations are discussed too late in the process. This can result in:

- Longer time to hire (28%)

- Increased workload for employees (26%)

- Higher recruitment costs (22%)

Encouragingly, many employers are already taking action. 54% say they publish salary ranges and 60% of job ads now include salary information.

Looking ahead to 2026, almost one in four large businesses (24%) plan to publish salary ranges for each role, rising to 27% among SMEs.

Further reading

Benefits trends across 2025

With salary increases under pressure, employers are increasingly using benefits as a differentiator.

For example, our research shows a 73% year-on-year increase in mentions of access to virtual GP and health assessments on job adverts, with other significant increases for:

- Social events and team activities (29%)

- Mental health and wellbeing support (24%)

- Health insurance (24%)

So, as salary alone is no longer enough to remain competitive, employers must meet candidate expectations wherever possible. For example, lack of flexibility is a deal-breaker for 43% of workers, while work-life balance is the top career goal for 2026, highlighting a cost-effective opportunity for employers to meet candidate demand.

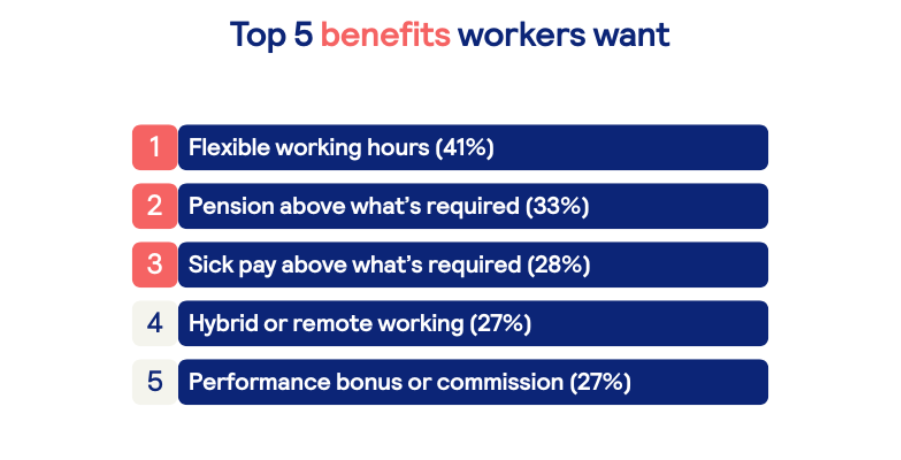

The most attractive benefits

Given the emphasis employees are placing on work-life balance, it’s unsurprising that flexible working hours (41%) are the most desirable benefit across the UK workforce.

Beyond talent attraction, providing this flexibility also supports the retention of existing staff members.

46% of workers say a good work-life balance makes them less likely to leave their current employer, while 43% wouldn’t apply for a role without flexible hours.

Benefits satisfaction

The latest research from Totaljobs shows that 76% of UK workers are satisfied with their current benefits package.

This high level of satisfaction suggests employers are responding to worker preferences, particularly around flexibility. To maintain this trajectory moving forward, employers will need to continually evaluate their benefits packages, focusing on aligning offerings with the evolving needs of the workforce.

Industries with the highest benefit satisfaction closely mirror those with high salary satisfaction, indicating that these sectors are doing a good job of providing comprehensive compensation packages. These industries include:

- Technology (91%)

- Banking and Finance (88%)

- Insurance (88%)

- Consulting (87%)

- Human resources (85%)

When it comes to business size, 79% of large business employees are satisfied with their benefits compared to 71% of SME employees. Interestingly, while SME workers are more likely to have access to flexible working hours (55% vs 61%), large businesses are more likely to allow hybrid or remote working (59% vs 42%).

UK Salary Trends Report 2026

Tips for employers

To successfully attract and retain the talent they need in 2026 and beyond, employers will need to carefully balance shifting candidate expectations with continuing economic challenges. Even as salary remains a key driver for candidates, transparency, flexibility and targeted benefits are becoming non-negotiables.

Below we’ve outlined some of the practical steps employers can take to stay competitive in the year ahead based on the findings of our research:

- Regularly benchmark salaries: With 80% of candidates avoiding roles without salary information and 51% of job switchers prioritising higher pay, offering competitive, clearly positioned salaries is essential. Salary benchmarking against industry and regional averages can help ensure pay remains aligned with market expectations, particularly in high-demand sectors facing skills shortages. Regular benchmarking also supports more confident salary conversations and helps reduce candidate drop-offs.

- Use pay reviews strategically: While 63% of workers received a pay rise in 2025, financial pressure remains widespread, and 41% of candidates plan to look for a new role in 2026. Regular, structured pay reviews, even where large increases aren’t possible, can help retain talent by demonstrating progression and fairness.

- Be transparent about salary: Salary transparency is no longer just a “nice-to-have”. With 89% of candidates more likely to apply when a salary range is listed, and 33% of recruiters reporting drop-offs when pay is discussed too late, publishing salary information upfront can significantly improve hiring efficiency. Transparency helps manage expectations, shortens time to hire and reduces wasted resources on misaligned applications.

- Strengthen benefits to offset salary pressure: As employers struggle to meet salary demands, benefits are increasingly important in attracting and retaining talent. Workers are prioritising flexible hours, enhanced pensions, sick pay and hybrid working, while demand for health and wellbeing support is rising. Reviewing and clearly promoting benefits can help employers remain competitive in the search for talent even when salary increases are limited.

- Embed flexibility where possible: Flexibility is a deal-breaker for 43% of workers, while work-life balance is the top career goal for UK employees in 2026. Employers that can offer flexible hours and hybrid/remote working options are better positioned to attract a broader talent pool and retain experienced employees. Even partial flexibility can significantly improve an employer’s appeal, particularly in competitive markets.

- Reinforce your EVP: While pay and benefits will always matter, employees also value stability, fairness and a supportive work environment. Clearly communicating your Employer Value Proposition (EVP), including development opportunities, wellbeing support and culture, helps differentiate your organisation and supports long-term retention, particularly in a market where financial uncertainty continues to influence worker behaviour.

Sign-up for our Strategy Bootcamp webinar on Thursday 22nd January for your all-in-one salary and benchmarking workout

About our research

Our data comes from OTT, an in-house job-ad analysis tool built by The Stepstone Group, which analyses job postings and associated data such as salaries, location, skills and benefits. We analysed 21.6 million UK job ads collected between 2019 and 2025, covering 22 industries. Salary and benefits data were extracted in November 2025 to provide a consistent view of how advertised pay and benefits have evolved over time. Using this dataset, we calculated the advertised gross median salary per industry, as well as city-level salary data across 21 major UK cities, including London, Manchester, Birmingham, Oxford, Leeds, Bristol and Edinburgh.

Insights from a worker and employer perspective come from two UK surveys conducted between 18 November and 26 November 2025. The worker survey captured responses from 3,000 UK workers and was weighted to be representative of the UK workforce by age, gender and region. The recruiter survey gathered responses from 1,000 recruiters and HR professionals. Sampling and weighting were aligned with previous years to ensure comparability, with industry-level boosts applied to ensure robust representation across all sectors analysed.

Explore articles

Receive the latest recruitment resources and

advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events,

and special offers from Totaljobs.