Hiring Trends Index: a look at the recruitment landscape of Q2 2021

Jump to the latest Hiring Trends Index (Q3 edition)

The latest Hiring Trends Index launched on 19th October 2021. Take a look at the most up-to-date findings.

Hiring Trends Index Q2 2021: Key findings at a glance

The second quarter of 2021 saw notable positives for the recruitment landscape, with 74% of businesses recruiting, compared to 63% in Q1. Of these businesses, 41% increased their hiring. In particular, medical & health (50%), hospitality & leisure (48%), media, marketing, advertising/PR & sales (48%) and transport & distribution (45%) increased their hiring above the average seen across the wider market. Only 14% of businesses paused recruitment at some point in the last three months (April-June), down from 23% in Q1. This is a promising sign that the job market is snowballing back into action. Many businesses are gearing up for the second half of the year, finalising strategies to maximise their success. With July 19th 2021 signposting the end of Covid-19 restrictions for England, the Government has announced that personal responsibility will replace legal requirements. In light of this news, many businesses, particularly hospitality, retail and the arts will be looking forward to welcoming customers back at full capacity. However, the predicted rise in self-isolation ‘pings’ from the Covid-19 app is a concern for many business who are already facing staff shortages.Top takeaways from the Hiring Trends Index Q2

- 41% of businesses increased recruitment in Q2 2021, shooting up from 26% in Q1

- In Q3, 29% of businesses expect to increase recruitment, while over a quarter (27%) expect to increase spend for specialist roles

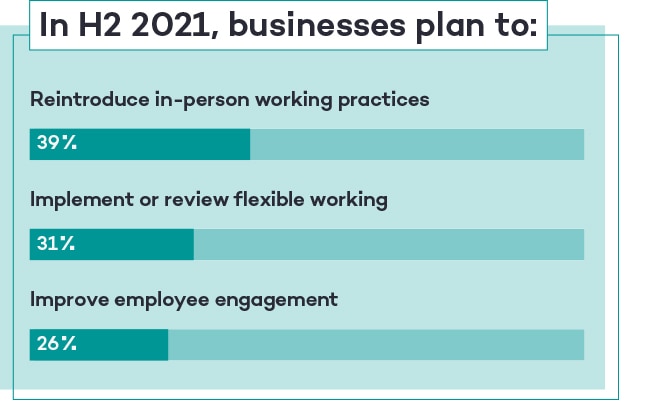

- The actions employers are looking to take in H2 include re-introducing in-person working practices (39%), implementing or reviewing flexible working policies (31%) and boosting employee engagement (26%)

The last three months

Of the businesses which recruited in Q2, 23% hired operations roles, 20% IT/tech, 19% sales, 15% customer service and 13% finance and general management. While many businesses ramped up recruitment, 26% did not hire at all in the last three months, falling from 37% as reported in Q1. Some businesses also took the time to interrogate how they operated, with just less than a quarter (23%) restructuring teams or departments, up slightly from Q1 figures.

Industries reporting increased recruitment in Q2 2021

17 As economic activity in the UK remains steady, it’s no surprise that HR Decision Makers are reporting a rise in total hours worked; over a quarter (26%) saw an increase, up from 17% last quarter. Meanwhile, only 11% saw a fall in hours worked – it’s likely this will decrease again in Q3.Sectors experiencing an increase in total working hours:

- Hospitality & leisure: 48%

- Medical & health: 32%

- Retail: 30%

Sectors experiencing a decrease in total working hours:

- Hospitality & leisure: 18%

- Retail: 18%

- IT & telecoms: 16%

Recruitment in Q3 2021

Looking ahead to Q3, hiring confidence remains steady, with employers also anticipating more focus on increasing recruitment spend for specialist roles (27%). Alongside this, 12% of employers plan to increase their spend for non-specialist roles. Across the market, 29% of businesses expect to increase recruitment in Q3, with media/marketing/advertising, PR & sales and transport & distribution leading the way (46% and 42% respectively). Only 13% of employers don’t anticipate hiring at all.

Across the market, 29% of businesses expect to increase recruitment in Q3, with media/marketing/advertising, PR & sales and transport & distribution leading the way (46% and 42% respectively). Only 13% of employers don’t anticipate hiring at all.

On average, over half (56%) of HR Decision Makers confident in their ability to hire the people they need in the coming months, while some sectors report an even higher rate[1]:

On average, over half (56%) of HR Decision Makers confident in their ability to hire the people they need in the coming months, while some sectors report an even higher rate[1]:

Media, marketing, advertising/PR & sales has been summarised as Marketing, PR & sales in this data visualisation.

Media, marketing, advertising/PR & sales has been summarised as Marketing, PR & sales in this data visualisation.

Businesses refining plans for second half of 2021

Future of work

Many employers are looking to implement the learnings Covid-19 brought in terms of working life. In-person meetings, events or working practices will be back on the cards for 39% of employers in the second half of the year. With this, just under a quarter (23%) of employers will be redesigning the layout of their workspace, or downsizing office space as a result of Covid-19. Whether that’s removing desks, enabling continued social distancing, or providing more creative spaces to collaborate, office spaces could well be transformed in the coming months. Despite in-person interaction being a priority with the removal of Covid restrictions, businesses are also acutely aware of the need to address the future of work. 31% will be reviewing or implementing their flexible working policies before the end of 2021. Alongside this, a quarter (25%) of HR Decision Makers are reviewing employee perks and benefits, in the knowledge that priorities have changed for so many workers across the UK in light of the pandemic. 1 in 4 is rounded up from 23% in the above data visualisation.

1 in 4 is rounded up from 23% in the above data visualisation.Fostering a sense of community

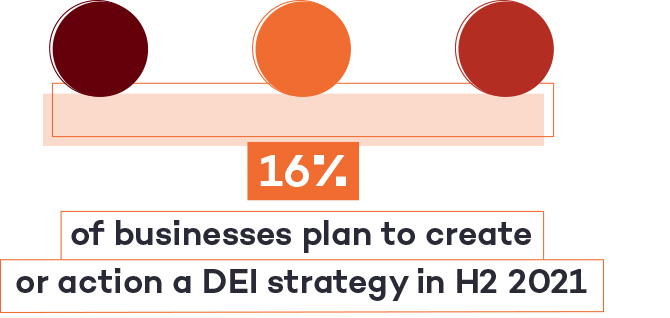

Tied in closely with the need to strike a balance between home and on-site work, maintaining a sense of community and company culture is a key action for employers in the months ahead, with over a quarter (26%) looking to implement practical ways of boosting employee engagement. Similarly, a fifth (20%) aim to establish a more inclusive working culture. This may be tied into a flexible work policy, or a Diversity, Equity & Inclusion strategy (16% of HR Decision Makers highlighted they would be creating or actioning this in the next six months).

Similarly, a fifth (20%) aim to establish a more inclusive working culture. This may be tied into a flexible work policy, or a Diversity, Equity & Inclusion strategy (16% of HR Decision Makers highlighted they would be creating or actioning this in the next six months).

Optimising recruitment

With vacancies are rising compared to candidate activity, businesses are focused on ensuring they can connect with the right talent, and quickly. Almost a fifth (18%) of HR Decision Makers reported that they will be looking to increase the number of people applying for their roles during the rest of this year in order to meet rising demand for their services. Taking steps to ensure the hiring process is equitable is also among the priorities for businesses in the next six months, with 21% aiming to attract a more diverse range of candidates to their roles.Totaljobs CEO, Jon Wilson, comments on the Hiring Trends Index Q2 edition

The Totaljobs Hiring Trends Index shows that recruitment has grown significantly in Q2, with four in ten businesses increasing their hiring compared to just 26% in Q1. With this, 29% of businesses plan to increase their recruitment in the coming quarter. As Covid-19 restrictions come to an end, we expect to see a flurry of activity in the months ahead in terms of recruitment and business planning, as highlighted by the actions employers plan to take in the second half of the year. As we transition out of Covid restrictions and realise the opportunities this offers, it’s also crucial for businesses to consider the needs of candidates and employees during this period. Listening to, taking care of, and ensuring staff feel comfortable has never been more important. Employers should reflect on how they can meet changing work preferences to keep hold of their staff and cement themselves as a competitive player in the market.

Jon WilsonCEO at Totaljobs

About the research

The Totaljobs Hiring Trends Index is a quarterly deep-dive into the trends that are shaping businesses now, and in the months and years to come. Our Q1 research focused on the first quarter of 2021 (from mid-December 2020 to mid-March 2021), while the Q2 edition asked HR Decision Makers about their experiences between April and June 2021. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1003 HR decision makers. Fieldwork was undertaken between 24th June-13th July 2021. The survey was carried out online. The figures have been weighted and are representative of all HR Decision Makers (aged 18+).HR Decision Makers were asked to rank their confidence in recruiting the people they need in Q3 2021 using a scale of 0-10, where 0 was not at all confidence and 10 was entirely confident. This means a ranking of 6 and above is considered confident.

Receive the latest resources and advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events, and special offers from Totaljobs.