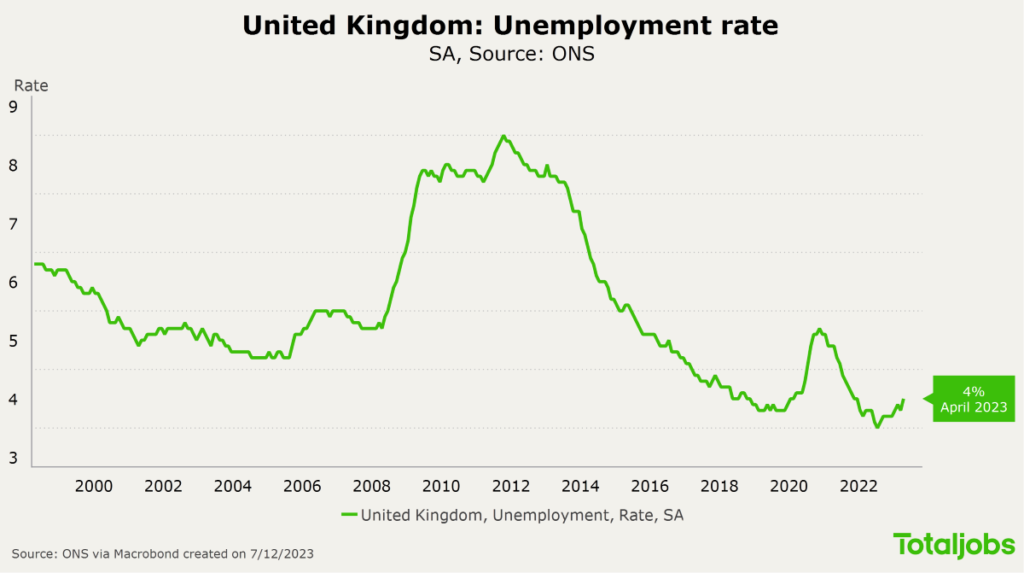

The UK unemployment rate rises to pre-pandemic levels

Table of Contents

- Key findings from the ONS data

- Part-time employees drive employment up, and more retirees join the workforce

- Wage growth is highest in the finance and business services sector

- Totaljobs’ overview of the recruitment landscape

ONS estimates of labour market data (11th July 2023) show a loosening labour market. More people are looking for work, which caused the economic inactivity rate to decrease, but the unemployment rate to jump to 4%. Wage growth remains strong and is pressing against the Bank of Englands inflation target

The UK labour market is growing – more people are looking for work and the number of economically inactive is falling. However, this has caused the unemployment rate to rise to 4%, levelling with the pre-pandemic unemployment rate.

There are still over a million open vacancies in the UK and persisting labour shortages. Therefore, workers continue to hold a good negotiating position and are demanding salary increases to keep up with the inflation – which is challenging the Bank of England’s inflation target.

The latest data shows a high growth rate of 7.3% for regular pay from March to May 2023. Experts warn that the UK could experience a wage-price spiral due to the sticky inflation and continued wage growth.

Key findings from the ONS data

- As more people joined the UK labour market in the past couple of months, the unemployment rate jumped to 4%, returning to pre-pandemic levels.

- Unemployment was mainly driven by those who have been unemployed for the past 12 months.

- Although employment hasn’t caught up with pre-pandemic levels yet, it remains strong at 76%.

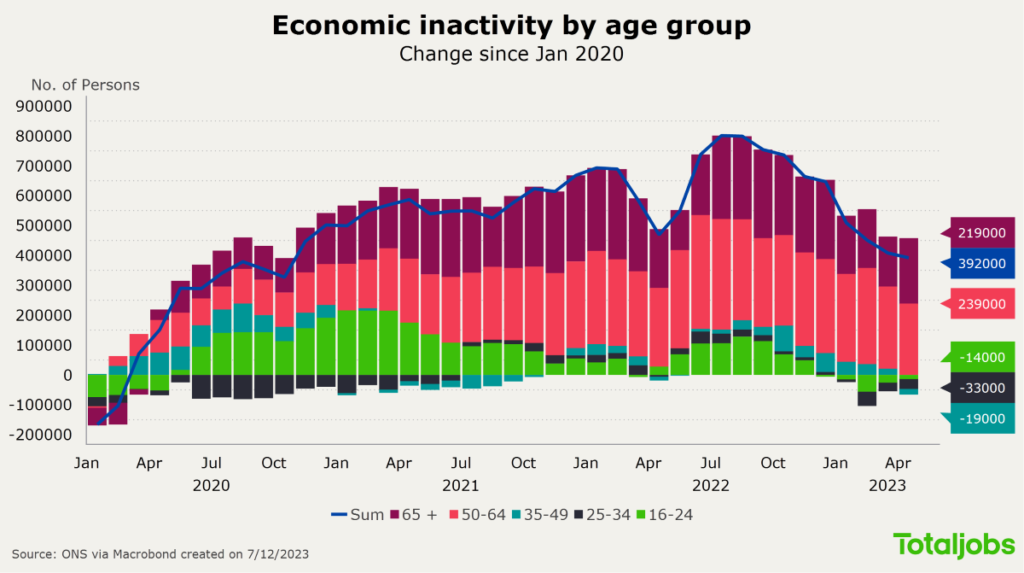

- The UK’s economic inactivity rate decreased to 20.8% in the latest quarter and now largely consists of those who report long-term sickness.

- The number of payroll employees seem to have plateaued at 30 million.

- Wage growth was higher than expected as private sector regular pay was 7.3% in March to May 2023, which is above the Bank of England’s inflation target but below the inflation rate. This makes another interest rate hike likely.

- The estimated number of vacancies fell for the twelfth consecutive period but remain above pre-pandemic levels at 1,034,000.

Part-time employees drive employment up, and more retirees join the workforce

The UK employment rate estimates showed another increase in March to May 2023. This quarter, the increase in employment was driven by part-time employees.

More economically inactive people started looking for work or joined the workforce. Most of these new joiners or returners previously reported economically inactive due to being retired or looking after family or home.

The rising cost of living and ongoing high inflation rate is the likely reason behind early retirees, students and other people returning to or joining the workforce. However, this talent pool might be having difficulties plugging the labour shortages that employers are experiencing.

The number of people unemployed up to 12 months has been increasing, showing a mismatch between available candidates and jobs.

Wage growth is highest in the finance and business services sector

The average regular pay growth was 7.7% for the private sector in March to May 2023, and 5.8% for the public sector.

On Monday 10th July, Bank of England governor Andrew Bailey and Chancellor Jeremy Hunt called for a wage restraint, in hopes to reach the inflation target.

The ONS reported “Finance and business services sector saw the largest regular growth rate at 9.0%, followed by the manufacturing sector at 7.8%; this is the highest regular growth rate we have seen for the manufacturing sector since comparable records began in 2001.”

Analysis by Trades Union Congress (TUC) found that pay rises for the top 10% of UK earners is likely driving the inflation, and that “among the top 1% of earners, those earning £180,000 or more, were being paid 7.9% more than last year.”

European Labour Economist Julius Probst comments

Julius ProbstEuropean Labour Economist

Totaljobs’ overview of the recruitment landscape

Our latest Hiring Trends Index provides an understanding of the revised economic outlook of the UK and how it impacts recruitment, while looking at skills and labour shortages as a primary hiring challenge for employers in 2023.

According to our data:

- 35% of businesses increased recruitment in Q1 compared to 30% in Q4.

- More than a third (37%) of HR leaders say labour/skills shortages is their top hiring challenge, which has replaced offering salaries in line or higher than inflation (34%).

- Majority of businesses are facing this challenge. Businesses are upskilling existing staff (35%), offering increased salaries and bonuses (29%), providing more flexible work arrangements (25%) or increased staff benefits (19%) and hiring entry-level talent (18%).

- One third (33%) of resignations in the past three months were driven by employees seeking a higher pay.

- Only 34% of businesses advertise specific salary and bonus information, which may be hindering their efforts to attract talent.

- The average mean time to hire stands still at 6.4 weeks, which is an improvement from 2022. However, it is still higher than the average time to hire in 2021.

Read our Hiring Trends Index to learn more about how economic factors are influencing the labour market and what employers are doing to attract and retain workers.

Explore articles

Receive the latest recruitment resources and

advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events,

and special offers from Totaljobs.