The cost of living continues to pull workers back into the UK labour market

The latest ONS data release (14th February 2023) shows more people join the labour market due to the rising cost of living. There was a significant flow of people from ‘economically inactive’ to unemployed, largely driven by young people looking for work. The number of vacancies persists at over one million, meaning employers will not stop hiring all together anytime soon to ensure they don’t struggle with labour shortages down the line.

According to the latest data, there is a slight increase in the number of people looking for work, and a decrease in the number of vacancies. As predicted, the labour market is cooling down, but labour shortages are still a pressing issue for businesses.

In an in-depth view on labour shortages and market tightness, Totaljobs’ EU Labour Economist Julius Probst pointed at three main factors: Brexit, the pandemic, and demographics. First and foremost, over half a million people in the UK reported long-term sickness as the reason behind economic inactivity – which is exacerbated by long NHS waiting lists.

However, there are still 1.6 million people in the UK who are looking for work. In the last three months, the increase in unemployment was driven mainly by young people aged 16 to 24 years.

Key findings from the ONS data

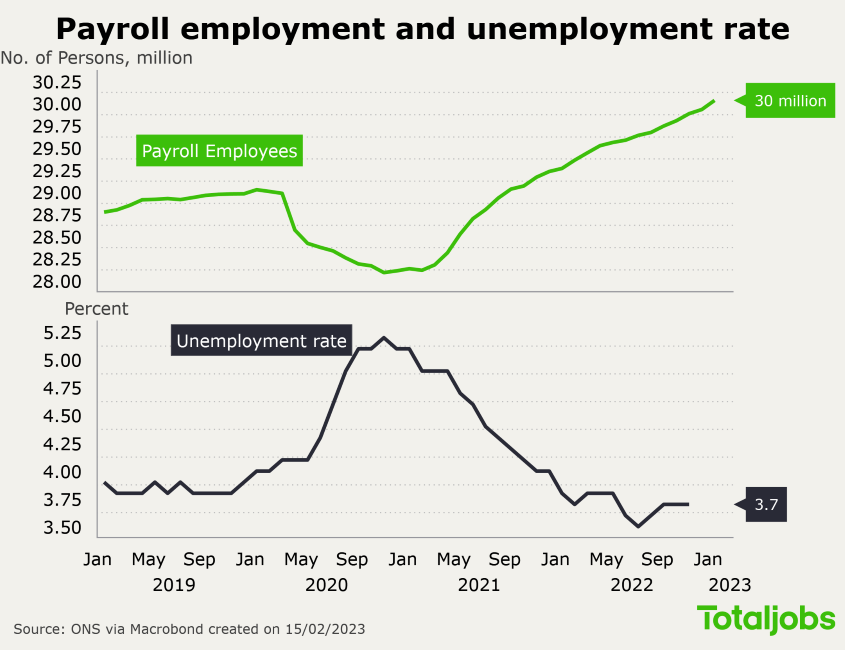

- The estimated number of payrolled employees in the UK is set to reach a new record at 30 million in January 2023.

- The number of workers on zero hours contracts hit a record high of 1.13m, showing that economic uncertainty in the UK is pushing employers to seek short-term solutions.

- The estimated number of vacancies continued falling but remain above pre-pandemic levels at 1,134,000.

- The rates of unemployment and employment are stagnating, at 3.7% and 75.6% successively. However, there was a 0.2% increase in employment in the past three months – driven largely by part-time workers.

- In the last three months, the number of people unemployed for up to six months rose mostly due to younger people looking for work.

- The increase in payrolled employees throughout the year (January 2022 to 2023) was largest in the health and social work sector and smallest in the wholesale and retail sector.

More young people are looking for work as cost of living bites

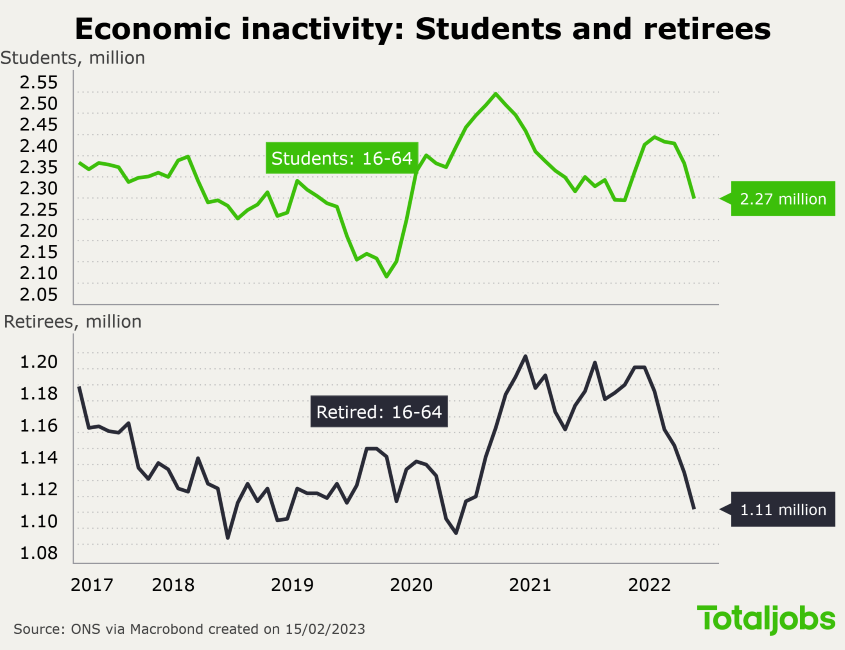

In the latest three-month period, the number of people unemployed for up to six months increased, driven by those aged 16 to 24 years. Young people that were previously economically inactive are increasingly looking for work, as the rising cost of living pushes people to try and increase their earnings. For the same reason, there was an increase in the proportion of workers with second jobs.

According to our research, young people are one step behind when it comes to their career prospects. They were hit with multiple hurdles, most notably the Covid-19 pandemic and the rising cost of living. In fact, 83% say Covid has had a negative impact such as missing in-person learning opportunities and being prevented from participating in work experience.

In the meantime, 54% of HR leaders had difficulties hiring entry-level talent. Businesses need to develop future talent more than ever to combat talent shortages and secure their growth.

Inflation eases, and the wage growth is likely to slow down

Some good news is on the horizon for the UK economy as the inflation is easing (declining to 10.1% in January 2023). There is a ‘return to work’ from those previously economically inactive, including young people and early retirees.

However, the reason behind the return is not as positive. The labour market is still strong with high demand and the increasing supply in the labour market means pay growth in the private sector will start cooling down in the coming months. Still, the demand for top talent is high and the right candidates are in short supply. Therefore, the competition between businesses who are after talent is heating up.

Our research shows that in 2023, higher salaries are the number one driver behind job searches, with 57% of those actively looking for roles saying they are after a higher salary. Yet, there are ways other than increasing salaries that can help employers attract and retain talent.

In light of the recent estimates, European Labour Economist Julius Probst said;

The UK saw more than 10% inflation last year due to the energy price shock and the negative economic impact from Brexit. The cost of living crisis is affecting us all but hitting the more vulnerable workers even more.

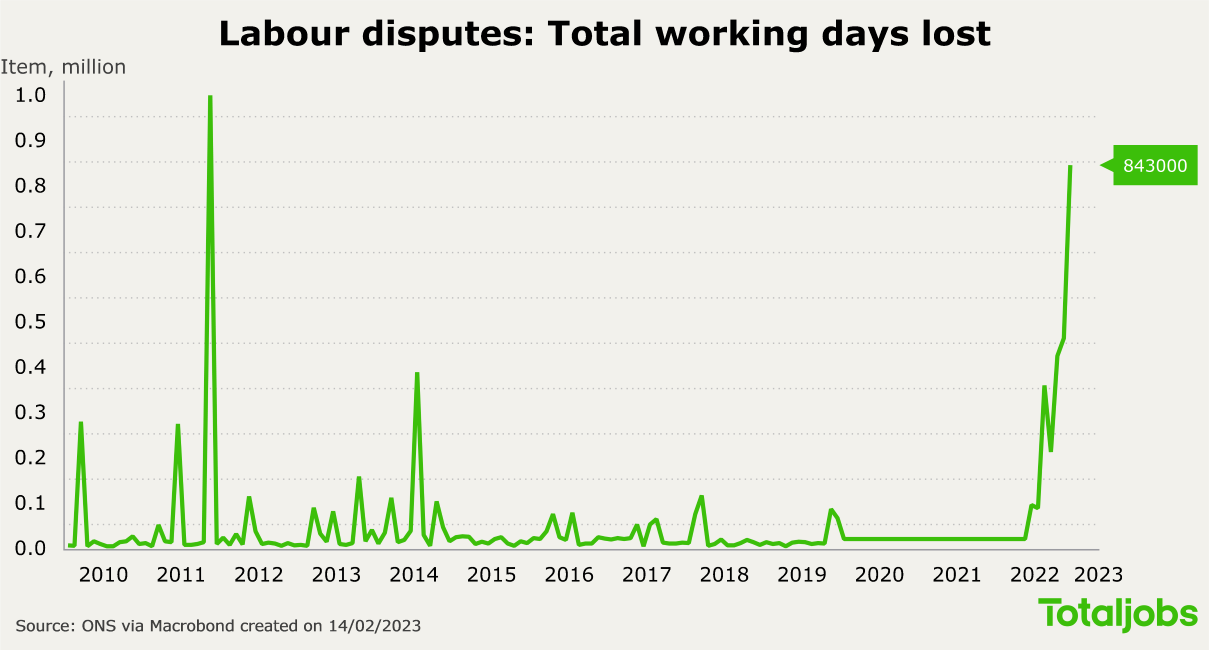

Although nominal wage growth has been accelerating, real wages declined by more than 2% in the private sector and more than 6% in the public sector in 2022. It is thus not surprising that the country is seeing the highest number of labour disputes in decades.

According to the most recent ONS labour market report, the total number of working days lost to strike reached 840.000 in December alone, and about 2.6 million for the entire year. The last time it was that bad was in 1989/1990 under Margaret Thatcher. Bloomberg estimates that the strikes might have subtracted some 0.2% of GDP in the last quarter of 2022. Due to the train strikes, commuters stayed away and shops, bars and restaurants in city centres have suffered from disruption on the public transport system.

Julius ProbstEuropean Labour Economist

Totaljobs’ overview of the recruitment landscape

Our latest Hiring Trends Index provides an in-depth look at the effect of inflation and the rising cost of living on employees and candidates, as well as employers’ plans to tackle their hiring challenges in 2023.

According to our data;

- Less than a third (30%) of businesses increased recruitment in Q4 compared to 35% in Q3.

- In 2023, employers expect inflation’s impact on business costs (41%) and meeting salary expectations (39%) to be their key challenges.

- One third (31%) of employees are planning to look for a new job in 2023, down from 90% in 2021 – pointing to the end of the Great Resignation.

- The pressure of finding the right talent continues to impact business, as more than a quarter (27%) expect filling vacancies will be challenging in 2023.

- The average mean time to hire has slightly decreased in the final quarter of 2022, falling to 6.4 weeks from 6.8 in Q3. This is still higher than the average time to hire in 2021.

- Higher salaries are the top driver behind job searches (57%) in next 12 months as jobseekers aim to counteract the rising cost of living.

Totaljobs’ Hiring Trends Index provides a quarterly view of the UK job market and the recruitment trends shaping it. In this edition, we look back at the final quarter of 2022 to understand how economic factors such as the cost of living are impacting UK businesses, workers, and jobseekers. Additionally, we draw on insights from HR decision-makers to predict the 2023 recruitment landscape.

- Read our Hiring Trends Index to learn more about how economic factors are influencing the labour market and what employers are doing to attract and retain workers.