Hiring Trends Index: a look at the recruitment landscape of Q1 2023

Table of Contents

- Key findings at a glance

- Top takeaways

- The last three months

- Recruitment in Q2 2023

- Ways businesses are addressing skills shortages

- Optimising job ads to attract more applicants

Totaljobs Hiring Trends Index provides a quarterly view of the UK job market and the recruitment trends shaping it. In this edition, we look at the first quarter of 2023 to understand how employers are navigating the ongoing challenges related to the economy, and labour and skills shortages.

Hiring Trends Index – key findings at a glance

The UK’s fiscal outlook dramatically improved according to the latest forecasts by the Office for Budget Responsibility (OBR). In his Spring Budget statement, Chancellor Jeremy Hunt announced that the UK has avoided a technical recession.

However, the UK is still the worst performing G7 country in terms of productivity. To address the productivity problem, the Chancellor, Jeremy Hunt announced plans to decrease the number of economically inactive people. This includes early retirees, parents, people with disabilities and long-term illnesses.

Even without the Chancellor’s actions, there has been an increase in labour participation in recent months due to the rising cost of living. Most recently, young people aged 16 to 24 have been joining the workforce by taking part-time jobs.

Similar to the last quarter of 2022, labour and skills shortages, and high inflation are the top concerns on employers’ minds in 2023.

Top takeaways from the Hiring Trends Index Q1 2023

- The labour market is stabilising, with the employment and unemployment rates stagnating at 75.7% and 3.7% respectively. OBR’s new forecasts predict that the unemployment rate will peak at 4.4%, instead of 4.9% in 2024.

- 78% of businesses recruited in Q1 2023, which is the same compared to the last quarter.

- More than a third (35%) of businesses increased recruitment in the first quarter of 2023, compared to 30% in Q4 2022.

- One third (33%) of resignations in the past three months were driven by employees seeking a higher pay. Consequently, 34% of businesses see offering salaries in line or higher than inflation as a major challenge. Positively, this has reduced from 39% in Q4 2022.

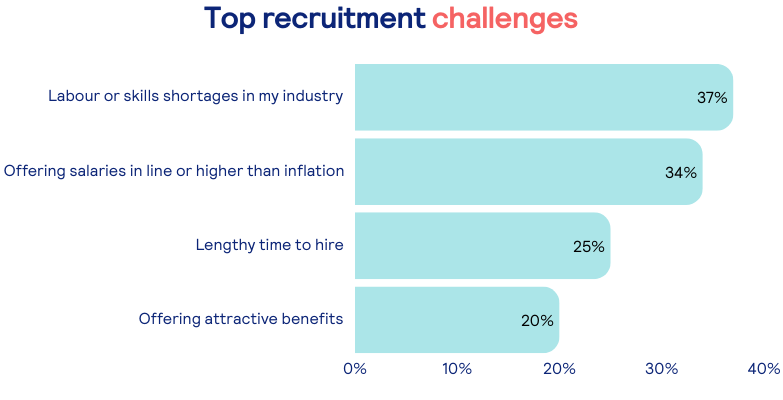

- When asked about their top recruitment challenge, more than a third (37%) of HR leaders said labour/skills shortages. According to our findings; Construction (51%), Transport and Distribution (58%) and Social Care (49%) industries are especially impacted.

- The average mean time to hire stands still at 6.4 weeks, and a quarter (25%) of businesses think lengthy time to hire is a challenge.

The last three months

78% of businesses recruited in Q1 2023, which is the same as the previous quarter. The economic outlook for the UK seems to be improving, and businesses are still hiring – albeit at a slower pace. The number of vacancies has been declining in the past few months, down from 1.3 million in April 2022 to 1.1 million in January 2023.

Due to the ongoing economic uncertainty, businesses began 2023 with caution. Some businesses are looking at existing staff to increase productivity. Almost a quarter (22%) of businesses restructured a department, team or wider business in Q1.

At the same time, businesses still need more people, and our findings show that 16% employed more temporary staff, freelancers or contractors (4% increase compared to the previous quarter). This indicates that employers could be looking at short-term hiring solutions due to financial factors.

Like the previous quarter, businesses that recruited in Q1 2023 were most likely to hire for Operations (24%), Technology/IT (23%), Sales (19%), and Customer Service (16%) roles.

Despite more joiners to the workforce, businesses still spent 6.4 weeks to hire the talent they need. The search for people with the right skills and experience is a top challenge for employers. A quarter (25%) of businesses reported lengthy time to hire as a concern this quarter, compared to 17% in Q4 2022.

Recruitment in Q2 2023

Despite the economic climate, over a quarter (28%) of businesses intend to increase recruitment in the next couple of months. Of those who plan to hire, almost one in five (18%) will increase recruitment spend for specialist roles. Meanwhile, 14% plan to hire more temporary workers, freelancers or contractors.

Positively, employers’ hiring confidence improved from 53% to 57% in the first quarter of 2023. This correlates with the improved outlook of the economy and the cooling down of the labour market.

Majority of employers (57%) think they will find the talent they need in 2023, with the most confidence in recruiting for Administration (77%), Logistics (75%), Banking (74%), Retail (70%), Finance and Accounting (68%), and IT & Telecoms (68%).

Wage growth slowed down in the past month, according to ONS data. Although offering salaries in line with or higher than inflation was a top concern in the past quarter, labour/skills shortages have taken this spot. Over one third (37%) of businesses report they are struggling to find the right people.

Yet, salaries are still the top priority for candidates and one third of resignations were due to staff seeking a higher salary in Q1 2023. According to our research, 57% of UK workers that are actively looking for a role in 2023 are seeking a higher salary.

Chancellor Jeremy Hunt’s Spring Budget was aimed at easing labour and skills shortages. His plans to scrap LTA (Lifetime Allowance), increase free childcare support and allow disabled people to continue claiming benefits while working could improve participation in the workforce.

However, experts are calling for the government to ease immigration rules for specific industries. For example, the growth in the construction industry has prompted the government to consider including builders and carpenters on the shortage occupation list.

Ways businesses are addressing skills/labour shortages

Over a third (37%) of businesses are dealing with labour/skills shortages. This was especially a challenge in Transportation and Distribution (58%) and Construction (51%) industries in Q1 2023. So, what are businesses doing to cope with them?

35% of businesses are upskilling their staff to combat labour and skills shortages, while over a quarter (29%) have increased salaries and/or bonuses. As most employees are experiencing a salary squeeze due to the ongoing high inflation and increased interest rates, supporting staff in monetary or non-monetary ways is crucial to be able to retain them.

Some businesses are also looking at other ways to fill labour and skills gaps. Almost one in five (18%) say they are hiring more entry-level talent. Offering apprenticeships is a great way to develop future talent after they have experienced a period of alienation from the workforce. It can also help reduce skills gaps in the long-term.

Even with the UK government’s plans, only 12% of businesses are focusing on attracting older/retired workers back into the business. Meanwhile, 16% are investing in technology and automation to supplement the workforce, 12% are hiring from other parts of the UK.

About one in ten (11%) are looking overseas to find the talent they need. This rises to 25% in social care and 19% in medical & health services.

Optimising job ads to attract more applicants

The current economic climate makes candidates just as wary as businesses. So, they are paying closer attention to salaries and benefits (68%), company reviews, and even business performance (52%). In fact, 62% of people say they are more likely to ignore a job posting if it does not disclose a salary.

According to our findings, only a third (34%) of businesses advertise specific salary and bonus information, and 35% include detailed company benefits on their job ads.

Most often employers advertise; required skills (62%), a description of the company (57%), desired skills (56%), description of day-to-day activities (49%), exact location (45%), contracted work hours (44%), and flexible working arrangements (39%).

In order to attract more candidates, employers should consider being transparent about their salary and benefits packages, and flexible working arrangements.

Flexible working arrangements can range from one remote day a week to a couple hours of paid medical leave for doctors’ appointments, or more paid sick leave.

The UK economic outlook has considerably improved in recent months and most forecasters now expect the UK economy to avoid a recession in 2023.

However, GDP growth will stagnate and only pick up next year while inflation will remain high for now. With households continuing to suffer from the cost-of-living crisis, it is no wonder that salary and benefit packages are the most important concern for jobseekers right now.

The good news is that even with the economic slowdown, UK unemployment is expected to remain low. While hiring has slowed somewhat, many companies continue to recruit. And labour and skills shortages remain prevalent in some sectors.

Julius Probst, Labour Economist

Totaljobs – Your hiring solution partner

Work with an industry-leading hiring solutions provider that understands your challenges. Find the right people for your business by reaching wider talent pools, increasing your brand’s visibility and maximising your hiring budget.

Company Profile – make your company stand out

Create a dedicated company page to show what it’s like to work for your company. Introduce your company culture and mission to potential applicants. Better informed candidates increase the relevancy of applications.

Global Hiring – hire globally, with local support

Find the talent you need in one integrated platform. Reach candidates in over 135 countries with one account manager who speaks your language and works in your time zone. Whether you’re hiring remote workers or talent to relocate from overseas, do it with ease.

HR decision-maker’s sample

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,002 HR decision-makers. Fieldwork was undertaken between 10th – 20th March 2023. The survey was carried out online. The figures have been weighted and are representative of business size.

Explore articles

Receive the latest recruitment resources and

advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events,

and special offers from Totaljobs.