Students are the driving force behind the decrease in economic inactivity

Table of Contents

- Key findings from the ONS data

- Supporting young people into employment

- The UK economy is showing signs of slow recovery

- Totaljobs’ overview of the recruitment landscape

The ONS released its latest estimates of labour market data (16th May 2023), showing a continuing increase in labour participation. This increase is largely driven by students who are working part-time or looking for part-time employment as well as self-employed workers. Meanwhile, the number of unemployed for over 12 months has been increasing.

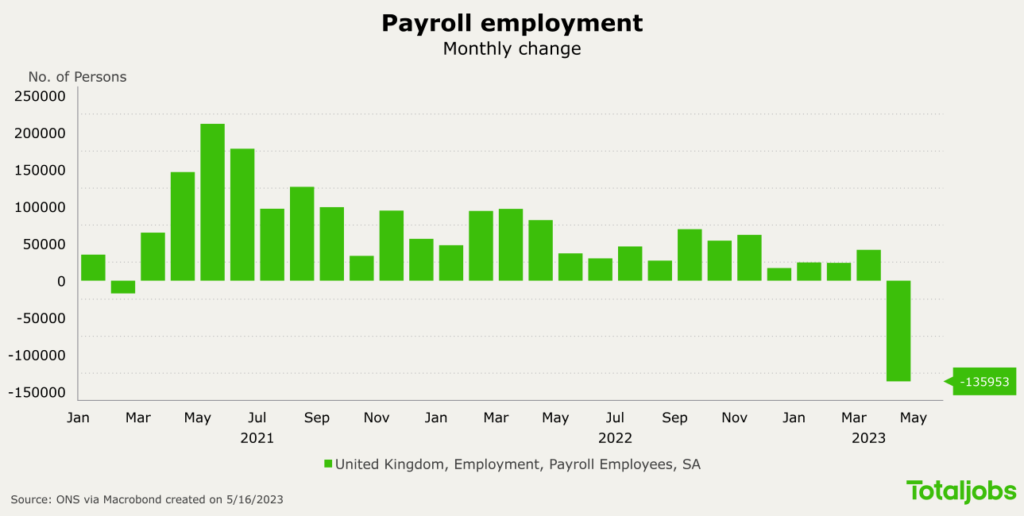

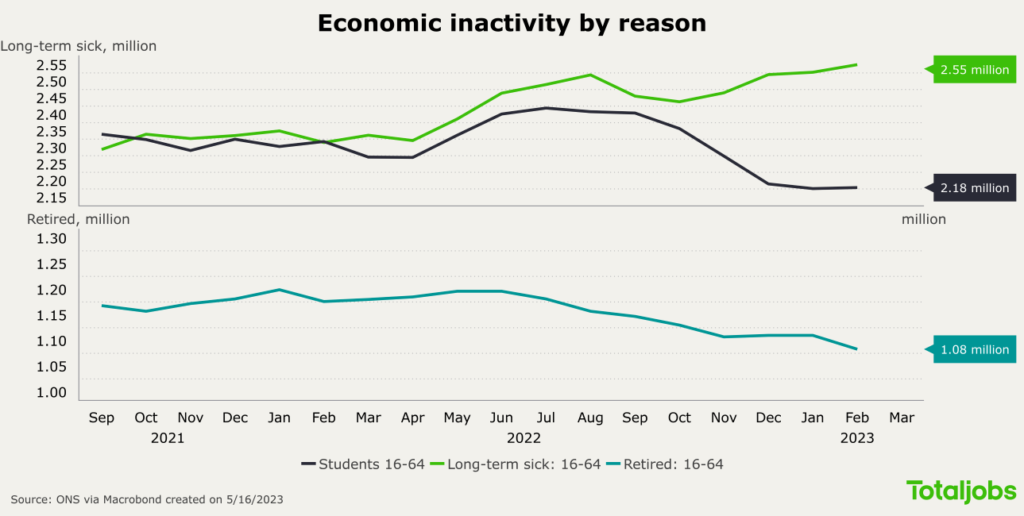

The economic inactivity rate in the UK has been declining in the past months as more people join the workforce to cope with the rising cost of living. Although this is good news for the UK economy to increase output, the most recent data shows an increase in unemployment as well. According to ONS data from the latest period, the uptick in unemployment was driven by people looking for work for over 12 months. Meanwhile, young people aged 16 to 24, and students were driving the decrease in economic inactivity in the past quarter. Despite the decrease in economic inactivity in this period, the number of those who report long-term sickness as a reason continue to be well above 2.5 million. Surprisingly, ONS data also showed a decline in the number of payroll employees for the first time since February 2021, but this remains a provisional estimate until the data is revised next month.  The rising cost of living continues to squeeze salaries significantly more in the public sector, which is causing the ongoing labour disputes. In March alone, there were 556,000 working days lost due to strikes.

The rising cost of living continues to squeeze salaries significantly more in the public sector, which is causing the ongoing labour disputes. In March alone, there were 556,000 working days lost due to strikes.

Key findings from the ONS data

- The employment and unemployment rates slightly increased in the most recent period, to 75.9% and 3.9% respectively.

- The estimated number of vacancies fell again, for the tenth consecutive period but remain above pre-pandemic levels at 1,083,000, in 14 industries (out of 18).

- The estimate of payroll employees for April 2023 shows a monthly decrease, down to 29.8 million. In March’s estimates, this number was at a record level at 30 million. However, ONS reports that this should be treated as a provisional estimate and will be revised next month.

- The Bank of England raised interest rates for the twelfth time, from 4.25% to 4.5% to curb inflation.

- Although inflation has eased to 8.9% in March 2023, food prices are still soaring and perpetuating the rise in cost of living.

- The economic inactivity rate is slowly falling, and it reached its lowest level in the past three years in March 2023 (21%). However, the number of people who are long-term sick is still over 2.5 million.

Supporting young people into employment

16 to 24 year olds are juggling studies and work, according to ONS data. Since the beginning of the year, more young people have been joining the workforce to increase household income and to cope with the rising cost of living. According to our research, the Covid-19 pandemic and rising cost of living have been significant barriers when it comes to young people’s career prospects. At the same time, more than half (54%) of HR leaders say they have difficulties hiring entry-level talent.

Our latest Hiring Trends Index found that almost one in five (18%) employers are hiring more entry-level talent to cope with labour shortages. It’s clear that more employers could benefit from supporting young people into employment, and young people need all the support they can get.

The UK economy is showing signs of slow recovery

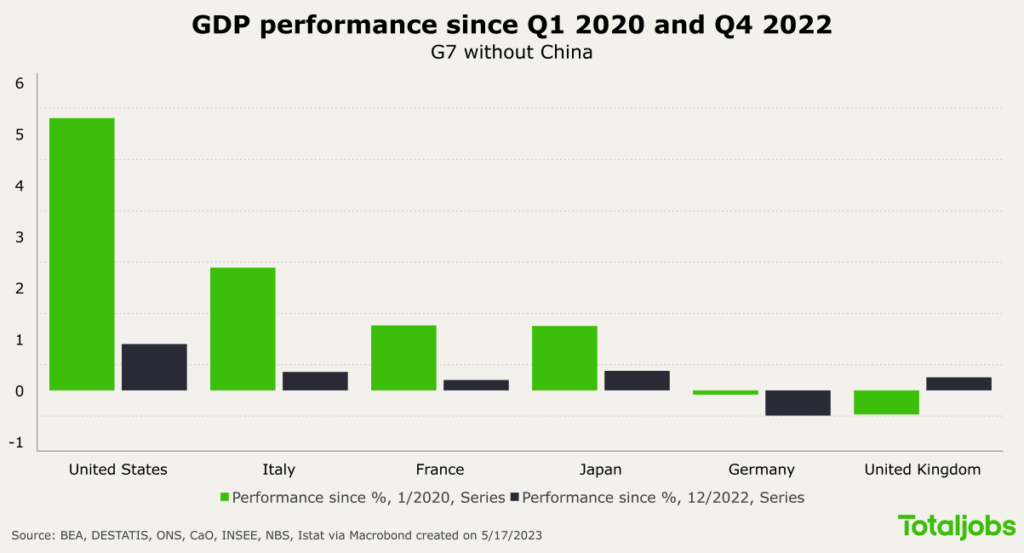

According to recent estimates, the UK showed no growth throughout February and GDP fell by 0.3% in March. Positively, the inflation rate has eased to 8.9%, but the inflation rate for food and non-alcoholic beverages continue to rise, reaching 19.2% in March. As a result, the inflation is still eating away at workers’ wages.

The Bank of England (BOE) raised interest rates for the twelfth time from 4.25% to 4.5% to bring inflation down, which is putting further pressure on mortgage payers. But the BOE is positive that the UK will avoid a recession in 2023 and the inflation will come down. At the same time, the UK outperformed Germany according to the data from the first three months of the year. However, it still falls short in the G7 competition.  European Labour Economist Julius Probst’s review of the data

European Labour Economist Julius Probst’s review of the data

Totaljobs’ overview of the recruitment landscape

Our latest Hiring Trends Index provides an understanding of the revised economic outlook of the UK and how it impacts recruitment, while looking at skills and labour shortages as a primary hiring challenge for employers in 2023. According to our data;

- 35% of businesses increased recruitment in Q1 compared to 30% in Q4.

- More than a third (37%) of HR leaders say labour/skills shortages is their top hiring challenge, which has replaced offering salaries in line or higher than inflation (34%).

- Majority of businesses are facing this challenge. Businesses are upskilling existing staff (35%), offering increased salaries and bonuses (29%), providing more flexible work arrangements (25%) or increased staff benefits (19%) and hiring entry-level talent (18%).

- One third (33%) of resignations in the past three months were driven by employees seeking a higher pay.

- Only 34% of businesses advertise specific salary and bonus information, which may be hindering their efforts to attract talent.

- The average mean time to hire stands still at 6.4 weeks, which is an improvement from 2022. However, it is still higher than the average time to hire in 2021.

Read our Hiring Trends Index to learn more about how economic factors are influencing the labour market and what employers are doing to attract and retain workers.

Explore articles

Receive the latest recruitment resources and

advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events,

and special offers from Totaljobs.