Hiring Trends Index: a look at the recruitment landscape of Q3 2021

Hiring Trends Index Q3 2021: Key findings at a glance

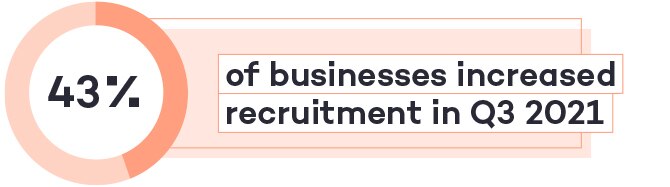

This summer brought an uplift in recruitment for the third quarter in a row, with 43% of UK businesses increasing their hiring between July and September, up a notable 17% from Q1 and a modest 2% from Q2. This mirrors the wider growth we’ve seen across the market as the economy bounces back after Covid-19, with a record number of jobs advertised over the summer and unemployment figures dropping for eight months in a row – even with the furlough scheme wrapping up on 30th September. Top recruiting industries during this period included the Medical & Health sector (50%); Media, Marketing, Advertising/PR & Sales (50%) and IT & Telecoms (49%), with the most sought-after hires being for roles across IT/tech (27%), Operations (25%), Sales (19%) and Customer Service (18%). Looking to the months ahead, skill shortages and retention issues loom large in the minds of HR Decision Makers, with 29% and 28% reporting these as top challenges to navigate in Q4, respectively. This is no surprise given candidate activity has not yet caught up with employer demand. Despite these hurdles, recruitment confidence remains steadfastly high. Almost three-fifths (58%) of businesses are confident they’ll find the people they need to see them through the remainder of the year.Top takeaways from the Hiring Trends Index Q3

- 43% of businesses increased recruitment in Q3 2021, shooting up from 26% in Q1.

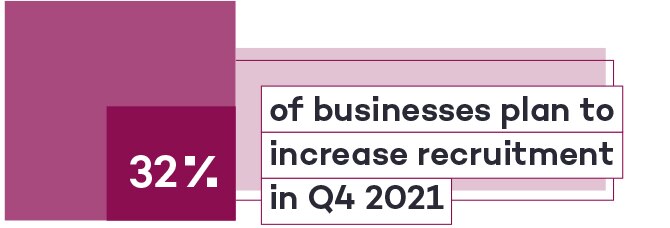

- A third (32%) of businesses plan to increase recruitment in Q4, with 28% increasing hiring spend for hiring specialist roles and 18% for non-specialist roles.

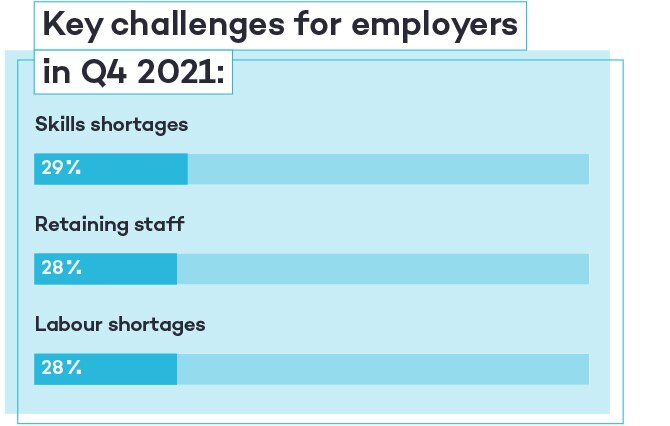

- The top challenges employers anticipate for Q4 are: skill shortages in their industry (29%), retaining staff (28%), labour shortages (28%), lengthy time to hire (24%) and a lack of job applications (24%).

The last three months

Two-fifths (43%) of businesses increased recruitment throughout Q3, shooting up from 26% at the start of the year. In fact, current vacancies are the highest they’ve been since records began, according to the ONS. The majority of new hires went into IT/Tech (27%), Operations (25%), sales (19%) and customer service (18%) roles. The number of businesses not recruiting – or pausing their recruitment – has declined quarter on quarter too. Only a fifth of businesses (22%) decided not to hire in Q3, a drop of 15% since the start of the year. 14% hit pause on their recruitment at some point in the last three months, versus 23% in Q1.

Other HR Decision Makers relied on restructuring their existing teams over recruiting, to meet the changing needs of their business.

In fact, 1 in 4 (26%) say their business has reshuffled departments during this period, while only 12% made redundancies – echoing the reports from the BBC and Insolvency Service that the end of furlough didn’t lead to a spike in redundancies, as some experts feared.

The number of businesses not recruiting – or pausing their recruitment – has declined quarter on quarter too. Only a fifth of businesses (22%) decided not to hire in Q3, a drop of 15% since the start of the year. 14% hit pause on their recruitment at some point in the last three months, versus 23% in Q1.

Other HR Decision Makers relied on restructuring their existing teams over recruiting, to meet the changing needs of their business.

In fact, 1 in 4 (26%) say their business has reshuffled departments during this period, while only 12% made redundancies – echoing the reports from the BBC and Insolvency Service that the end of furlough didn’t lead to a spike in redundancies, as some experts feared.

Industries reporting increased recruitment in Q3 2021

18 With unfilled vacancies across the market and heightened customer demand for many industries, it’s fitting that we’re seeing working hours creep up. 29% of HR Decision Makers reported an increase in total hours worked, up from 26% from Q2 and from 17% in Q1, with the main sectors experiencing this increase being:- Hospitality & leisure: 44%

- Construction: 35%

- IT & telecoms: 34%

Recruitment in Q4 2021

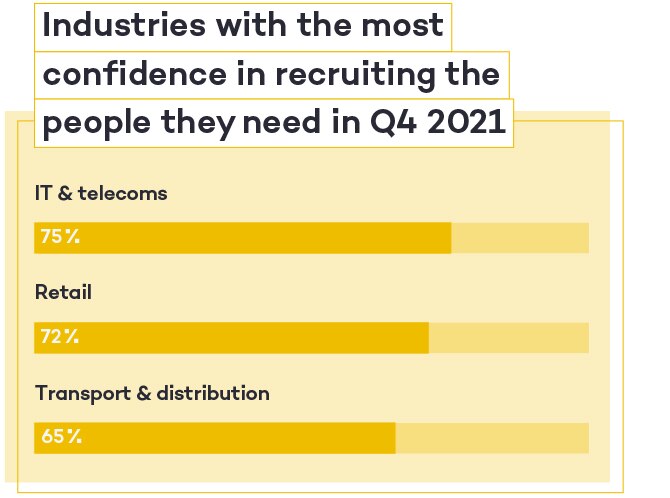

Looking ahead to the tail end of the year, hiring confidence remains strong. Almost 6 in 10 businesses (58%) are confident they’ll fill vacancies before 2021 wraps up, with the IT & telecoms (75%) and retail (72%) industries the most assured. Despite widely reported labour shortages, HR Decision Makers in the transport & distribution industry also have a particularly high level of confidence, at 65%.

Almost 6 in 10 businesses (58%) are confident they’ll fill vacancies before 2021 wraps up, with the IT & telecoms (75%) and retail (72%) industries the most assured. Despite widely reported labour shortages, HR Decision Makers in the transport & distribution industry also have a particularly high level of confidence, at 65%.

Across the market, a third (32%) say their businesses plan to increase recruitment for the final quarter of the year, with industries like IT & telecoms (40%), media, marketing, advertising/PR & sales (38%), hospitality & leisure and construction (both 36%) leading the charge.

In contrast, only 11% of HR Decision Makers don’t anticipate hiring in the next few months, down from 18% who reported this in Q1.

Across the market, a third (32%) say their businesses plan to increase recruitment for the final quarter of the year, with industries like IT & telecoms (40%), media, marketing, advertising/PR & sales (38%), hospitality & leisure and construction (both 36%) leading the charge.

In contrast, only 11% of HR Decision Makers don’t anticipate hiring in the next few months, down from 18% who reported this in Q1.

Key challenges to overcome in Q4 2021

Recruitment activity is increasing quarter on quarter, but not without growing pains. The ongoing effects of past lockdowns and Brexit, coupled with the largest population drop in the UK since the Second World War, has caused candidate activity to fall behind vacancies.

This is likely why 1 in 4 businesses (24%) anticipate a lack of job applications to be a key challenge in Q4, with a similar amount (24%) pointing to lengthy time to hire.

The ongoing effects of past lockdowns and Brexit, coupled with the largest population drop in the UK since the Second World War, has caused candidate activity to fall behind vacancies.

This is likely why 1 in 4 businesses (24%) anticipate a lack of job applications to be a key challenge in Q4, with a similar amount (24%) pointing to lengthy time to hire.

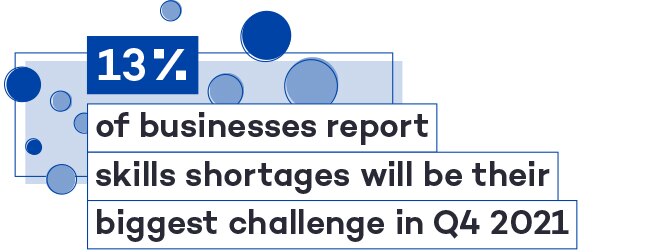

Combined, these exacerbate long held skill shortages across the market. In fact, ‘skill shortages in my industry’ was the most cited challenge that HR Decision Makers expect to face over the coming months, closely followed by retaining staff (28%) and industry-wide labour shortages (28%).

13% even pointed to the skills gap as the single biggest problem they’ll have to navigate before the new year.

Businesses facing this challenge can look to training and upskilling programmes for existing staff, while increasing application volume by reengaging passive candidates, utilising targeted programmatic solutions, and working to attract candidates from outside of their industry.

Combined, these exacerbate long held skill shortages across the market. In fact, ‘skill shortages in my industry’ was the most cited challenge that HR Decision Makers expect to face over the coming months, closely followed by retaining staff (28%) and industry-wide labour shortages (28%).

13% even pointed to the skills gap as the single biggest problem they’ll have to navigate before the new year.

Businesses facing this challenge can look to training and upskilling programmes for existing staff, while increasing application volume by reengaging passive candidates, utilising targeted programmatic solutions, and working to attract candidates from outside of their industry.

Businesses refining plans for the final quarter of 2021

Balancing on-site and flexible working

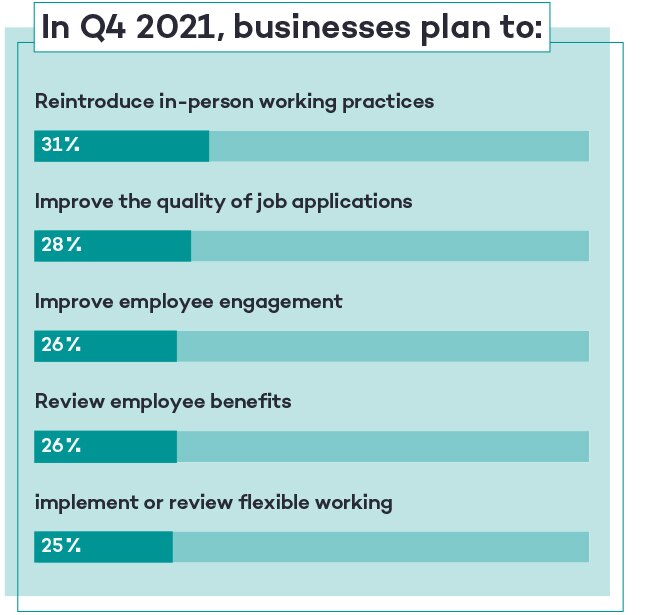

Looking to the end of the year, a priority for businesses continues to be striking the balance between encouraging staff back on-site, while offering the flexibility that has become normalised for many during Covid-19. 31% of HR Decision Makers plan to reintroduce in-person meetings and events throughout Q4, with a quarter continuing to review or rollout their flexible working policies. 9 in 10 employees now expect some degree of flexibility over their work hours in the wake of Covid-19, but the process of embedding – and sustaining – flexible work policies remains a sticking point for many businesses. In fact, 1 in 5 perceive that maintaining flexible working will be a challenge for the months ahead.Building robust talent pipelines

While a quarter (24%) of businesses flagging a lack of job applications as an ongoing challenge, it’s interesting to see that most are focussed on improving the quality – not quantity – of applications in the coming months.

28% say that improving application relevancy is on the agenda for Q4, with 17% looking to lift the quality of external applications, and 18% hoping to improve internal applications.

This highlights how businesses are continuing to build out their talent pipeline with a two-pronged approach – driving external applications, for example focusing on attracting candidates from compatible industries, while fostering existing talent through training and development plans.

Employers wanting to adopt a similar approach should ensure they’re covering the essentials with their job ads, while exploring how solutions like candidate webinars, internal training or upskilling programmes, and CV workshops could fine-tune the applications they receive.

While a quarter (24%) of businesses flagging a lack of job applications as an ongoing challenge, it’s interesting to see that most are focussed on improving the quality – not quantity – of applications in the coming months.

28% say that improving application relevancy is on the agenda for Q4, with 17% looking to lift the quality of external applications, and 18% hoping to improve internal applications.

This highlights how businesses are continuing to build out their talent pipeline with a two-pronged approach – driving external applications, for example focusing on attracting candidates from compatible industries, while fostering existing talent through training and development plans.

Employers wanting to adopt a similar approach should ensure they’re covering the essentials with their job ads, while exploring how solutions like candidate webinars, internal training or upskilling programmes, and CV workshops could fine-tune the applications they receive.

Boosting employee engagement and retention

28% of employers have flagged retention as a challenge for the months ahead and are looking to implement new ways to reengage staff and reenergise teams. 1 in 4 (26%) say their business is taking steps to increase employee engagement, with the same amount reviewing employee benefits and perks to ensure staff are satisfied, and to align with the new priorities staff have following Covid-19. These measures work to stem an exodus of talent, with Totaljobs research suggesting that while a third (32%) of people avoided applying for jobs during the pandemic, job-changing intent is on the rise again.In fact, 75% of the workforce are considering changing industries in the wake of the pandemic, with 2 million hoping to make this career leap before Christmas. Plus, in the current candidate-led market, jobseekers are more aware of their value to employers than ever before. Recent Totaljobs research found almost half of candidates (48%) say they’re more selective in the roles they’re applying for, two-fifths (42%) are more prepared to negotiate with a new employer, and 29% believe their skills are seen as more valuable in the current market. These factors, plus the proliferation of jobs available, means power has shifted back into the hands of candidates – and if their current employer isn’t meeting their needs, there are others who will. Ultimately, it’s the businesses that can balance their commercial objectives with key retention drivers that will reap the rewards in the long-run.Totaljobs CEO, Jon Wilson, comments on the Hiring Trends Index Q3 edition

26 % of HR Decision Makers say their business is taking steps to increase employee engagement in Q4.

“With candidate activity not yet meeting the record levels of vacancies in the UK, employers face heavy competition for talent. The challenges businesses anticipate in the final months of this year are very much interconnected, with skills shortages in some industries making it harder to meet customer demand, and open roles leading to existing staff picking up more work. This means that while employers are increasing recruitment, they’re also focused on retention, re-engaging and supporting existing staff to ensure the people they need are sticking around. “Despite some hurdles ahead, employers continue to feel confident about their position in the labour market. Meanwhile, people are increasingly searching for work-life balance, flexibility or simply for a role they can get more satisfaction out of, and they’re confident in moving jobs – or even moving industries – to get it. To take advantage of this, tailored messaging that makes it clear what your business truly offers its people will help to connect with relevant candidates.”

Jon WilsonCEO at Totaljobs

About the research

The Totaljobs Hiring Trends Index is a quarterly deep-dive into the trends that are shaping businesses now, and in the months and years to come. Our inaugural Q1 research asked HR Decision Makers about their recruitment plans and experiences from mid-December 2020 to mid-March 2021, our Q2 edition covered April to June 2021, and this Q3 edition reflects on shifts within recruitment from July to September 2021. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,014 HR Decision Makers. While there may be some overlap between samples, the surveyed HR Decision Makers are different for each edition of our Hiring Trends Index. Fieldwork was undertaken between 23rd September to 8th October 2021. The survey was carried out online. The figures have been weighted and are representative of all HR Decision Makers (aged 18+).HR Decision Makers were asked to rank their confidence in recruiting the people they need in Q3 2021 using a scale of 0-10, where 0 was not at all confidence and 10 was entirely confident. This means a ranking of 6 and above is considered confident.

Receive the latest resources and advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events, and special offers from Totaljobs.