Hiring Trends Index: a look at the recruitment landscape of Q1 2024

Totaljobs’ Hiring Trends Index informs recruiters about the latest trends in the UK job market based on insights from 1,000 HR leaders. This edition looks at the first quarter of 2024 with a focus on how businesses are impacted by skills shortages and the measures they are taking to tackle them.

The Q1 2024 edition of our Hiring Trends Index takes an in-depth look at insights from 1,000 HR decision-makers. This instalment focuses on the impact of skills shortages and what businesses are doing to address them.

Hiring Trends Index – market overview

The UK economy dipped into recession at the end of last year but quickly showed signs of recovery in Q1 2024. While recession news prompted some hiring hesitancy, the demand for workers is expected to increase as the economy recovers once more. This edition of the Hiring Trends Index shows that some businesses are already ahead of the curve in increasing their hiring and feel confident to recruit the people they need in the coming months.

Although ONS shows an ongoing downward trend when it comes to vacancies, there are still 916,000 open roles in the UK – which are still above pre-pandemic levels. The unemployment rate increased in the latest quarter from 3.9% to 4.2%. Positively, inflation fell to 3.4% – the lowest level in the past 2 years.

Economic inactivity has seen an uptick, rising to 22.2% and there are 2.8 million out of the workforce due to long-term illness. UK’s productivity is a key area of concern, with labour and skills shortages still impacting businesses – which is why we’re looking at how employers are addressing these challenges.

On the bright side, the UK’s economy will pick up in the coming months as the inflation and interest rates go down. Employers must prepare their business to meet rising demands and prioritise plugging their skills and labour gaps for today and tomorrow.

Top takeaways from the Hiring Trends Index Q1 2024

- 84% of businesses recruited in Q1 2024, increasing from 78% in Q4 and Q1 2023.

- 37% of businesses increased their hiring in Q1 2024, which is consistent with Q1 2023 (with January typically the busiest month for recruiters).

- The average time to hire dropped to 4.8 weeks on average and 5.1 weeks for larger businesses. (See methodology to learn more about the latest amendments in measuring this metric.)

- Positively, 74% of businesses are confident they will recruit the people they need in Q2 2024 despite rising economic inactivity and skills and labour shortages. At the same time, businesses are focusing more on internal mobility and upskilling to plug skills gaps in their organisations.

- 3 in 5 (59%) businesses are experiencing increased competition to find the talent with the right skills. As a result of skills and labour shortages, they face higher hiring times and costs, greater candidate expectations around salary and benefits as well as flexible working, and difficulty ensuring diversity of candidates.

The last three months – Recruitment overcomes recession

84% of businesses recruited in Q1 2024, increasing from Q4 of last year. Of those who hired, almost 2 in 5 (37%) increased their hiring while 18% paused it. This confirms that recruitment activity quickly jumped up following the recession, as January rolled in.

Businesses hired more temporary staff, freelancers, or contractors (27%) in the past three months than in Q4 (16%) as they evaluated the economic landscape. Similarly, more businesses (26% vs 21% in Q4) restructured a department, team, or wider business.

The high number of vacancies and low rate of unemployment continue to show a mismatch between jobs and workers. In fact, HR decision makers cite finding talent with the right skills (28%), finding the right talent generally (21%), and meeting candidate salary expectations (18%) as their top three hiring challenges.

Meeting candidate salary expectations was higher on the list of challenges for businesses in Q4 2023, but businesses are now more concerned about skills as inflation eases. Although this is good news for employers, there is increased competition for talent with specialist skills especially, and it’s necessary to benchmark salaries for businesses to remain attractive.

Industries that were most likely to have increased recruitment in the first quarter of 2024 were; IT & Telecoms (50%), Medical and Health Services (45%), Finance and Accounting (41%) and Hospitality & Leisure (40%) as labour and skills shortages in these industries continue to impact businesses.

Businesses that recruited in Q1 2024 were most likely to recruit for Technology/IT (35%), Operations (33%) Customer Service (32%) and HR (28%) roles, with the demand for HR professionals increasing compared to past quarters.

Percentage of firms which increased recruitment between January-March 2024

IT & Telecoms 50%

Medical & health services 45%

Finance & Accounting 41%

Hospitality & leisure 40%

Manufacturing 38%

Construction 35%

Legal 34%

Media/marketing/advertising/PR & sales 33%

Retail 33%

Education 31%

Real estate 24%

Transport & distribution 21%

Top recruitment challenges and reasons for staff departures in Q1

The top recruitment challenges HR leaders listed in the past 3 months were; finding talent with the right skills (28%), finding the right talent generally (21%) and meeting candidates’ salary expectations (18%).

Employers have been struggling to find talent with the right skills for some time. Therefore, the majority (59%) plan to train and upskill their employees to plug skills gaps in their organisations. Considering that 1 in 5 (21%) workers left due to seeking a career change, employers can invest in employees who are looking for a new challenge and boost their internal mobility efforts to retain talent.

Another one fifth (20%) left for a higher salary, and although rising salary expectations is a top hiring challenge for recruiters, concerns around this has eased compared to last year. Instead, HR decision makers report finding talent with the right skills (28%) and finding the right candidates generally as their top challenges.

Finding people with the right skills is especially a challenge in the following industries; Legal (40%), IT and Telecoms (38%), Medical and Healthcare (35%), Education 28%, Transport (27%). Employers also struggle with lengthy time to hire, meeting candidates’ flexible working expectations and finding enough candidates and time pressure to fill positions (all 17%).

Meanwhile, other reasons workers left their employer in Q1 include retirement (19%), relocation (19%) and physical or mental health issues (14%). As mentioned, more people are out of the workforce due to long-term illness than ever before. Our Salary & Benefits research shows that workers are looking for private health insurance as a benefit. Therefore, employers can invest in their employees’ health and wellbeing to attract and retain talent.

As a result of the economic landscape, almost a third of businesses (29%) reported no resignations – indicating that workers are still tentative to switch jobs.

Recruitment in Q2 2024 – Healthy hiring outlook and a focus on diversity

The majority (74%) of employers feel confident about finding the people they need in Q2 as the UK economy recovers.

We’ve seen the hiring confidence rise consistently over the last year, and as we start 2024 with a new panel of respondents to provide a better view of each industry and business size, the confidence levels increased further. Our most recent findings show that the hiring confidence is 84% for large businesses, however they lower to 51% for small businesses.

Similarly, the average time to hire* fluctuated throughout 2023 as the labour market loosened but hiring slowed. Our most recent findings show that it dropped to 4.8 weeks with the January job rush in 2024. As we continue to improve our insights, we asked HR decision makers how long it takes between advertising a role and filling a role – to track a specific time frame going forward.

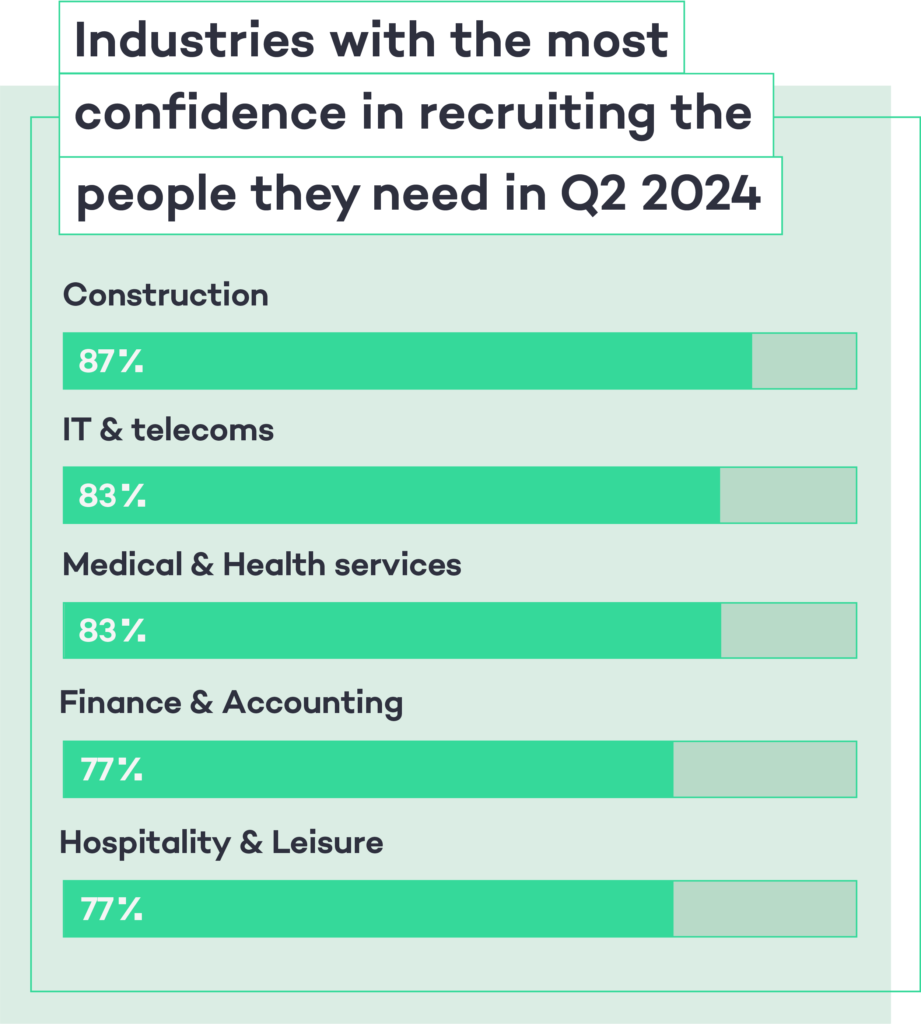

27% of businesses plan to increase recruitment in Q2 (consistent with Q4 2023), with Construction (36%), IT & telecoms (36%), Transportation and Distribution (29%), Media/Marketing/Advertising/PR & Sales (29%) and Manufacturing (29%) the most likely. These industries broadly mirror industries that are impacted by skills and labour shortages.

Almost 1 in 4 (23%) plan to increase recruitment spend on specialist roles, while 15% will do the same for non-specialist roles. The main industries planning to increase recruitment spend for specialist roles are; IT & Telecoms (30%), Legal (30%), Medical & Health Services (27%), Manufacturing (27%) and Construction (23%).

17% of businesses plan to increase recruitment for temporary staff or freelancers and 26% plan to take steps to make recruitment pools more diverse in Q2 2024 (a significant increase from 11% in Q4 2023).

The most popular method businesses use to improve diversity is upskilling staff and increasing opportunities for internal mobility (40%), followed by creating an inclusive company culture where people from different backgrounds can thrive (35%) and using skills-based hiring to assess candidates (34%).

The impact of skills and labour shortages on businesses

Rapid technological advancement, globalisation, the climate crisis and demographic shifts are changing the type of jobs and skills needed in our society. In fact, the World Economic Forum estimates that 44% of workers’ core skills will change in the next 5 years.

So, it’s no surprise that employers are struggling to find the talent with the skills they need, and 3 in 5 (59%) experience increasing competition while doing so. This rises to 74% for companies with over 1,000 employees and is particularly felt in Finance & Accounting (74%), Medical & Health Services (71%), and Manufacturing (67%) industries.

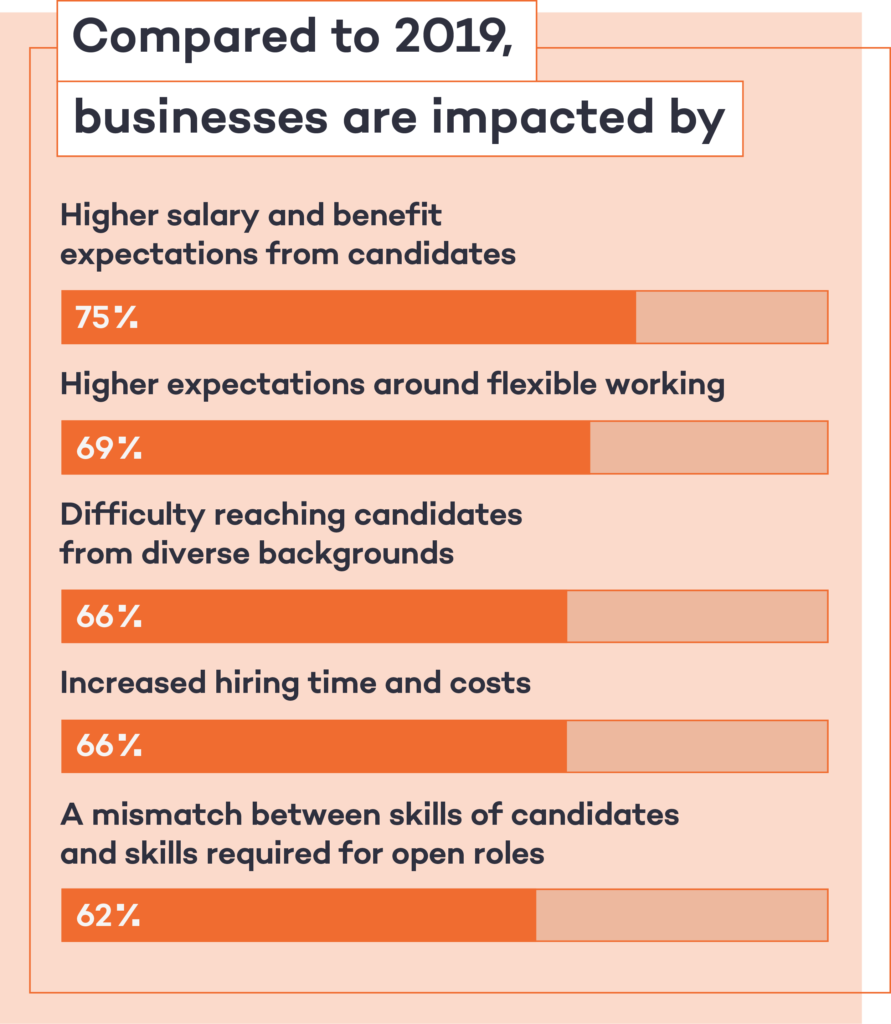

As a result of skills and labour shortages and the high level of inflation throughout 2022 and 2023, workers expect higher wages, better benefits, and flexible working arrangements. These challenges top the list for 59% of businesses that are experiencing increasing competition to find talent with the right skills compared to 2019.

Businesses also struggle to reach talent from diverse backgrounds (66%), observe an increase in hiring time and costs, and a mismatch between skills of candidates and skills required for open roles. Skills and labour shortages also have consequences for staff; such as an increase in workload and work hours.

Employers report that the departments most likely to be impacted negatively from skills shortages in 2024 are Technology/IT (29%), Operations (23%), and Sales (19%).

According to our Business Insights team, skills shortages especially impact recruiters at later stages of the hiring process. Candidates renegotiate higher wages or flexible work arrangements after an offer is made. This causes delays in hiring; exacerbating the challenges recruiters face such as time pressure to fill roles and lengthy time to hire.

Steps to overcoming skills shortages: upskilling and hiring

Skills and labour shortages clearly have a negative impact on businesses, and this ongoing challenge is a risk area for future business success.

That’s why the majority (83%) of businesses have taken action to address it, using methods such as: skills-based hiring (27%), upskilling staff through training courses and certification programmes (26%), investing in AI tools and training (25%), implementing new upskilling programmes (23%), conducting skills gap analysis and preparing a succession plan (both 21%).

A fifth of businesses also updated their learning and development offerings in line with skills gaps, implemented coaching or mentorship programmes and increased investment for talent with specialist skills.

These figures show that although the majority (59%) of businesses face skills shortages, only a fifth (21%) are conducting a skills gap analysis or preparing plans to address the gaps. Workforce planning and a succession plan can help businesses identify existing skill gaps, predict skill shortages, and fill those gaps with an effective people strategy.

Similarly, only a fifth updated their learning and development (L&D) offerings in line with skills gaps, while majority (59%) of businesses say they will train and upskill existing employees in Q2 2024. Businesses should make sure they have a L&D plan focused on specific skills, so employees are learning the skills and tools relevant to their job and career development and employers are future-proofing their workforce.

To address the skills shortages, businesses also say they will hire employees with the required skills (50%), increase salaries to attract talent with the required skills (40%) and use AI to supplement their workforce and address the skills gaps (34%) in the next three months.

Investing in staff by rewarding employees who upskill

The majority (59%) of employers say training and upskilling staff is their priority in the next three months. Therefore, motivating employees to invest the energy and time into development is key.

Positively, the majority (88%) of businesses reward staff that successfully complete a training or a certification program in some way. The most popular incentives are; offering career progression or promotion opportunities (49%), pay rises (44%), covering the cost of training or certification (36%) and offering a one-off financial reward (28%). It’s no surprise that businesses offer career progression and promotion opportunities to staff who upskill, because this can reduce staff turnover as a result.

Investing in new talent by using skills-based hiring

85% of employers use at least one skills-based hiring method to hire talent with the right skills.

Considering the hiring challenges caused by skills shortages, these employers are one step ahead. Perhaps the easiest, and the most popular method businesses use is updating job adverts to focus on skills and competencies (43%). This can also help reduce bias and boost candidate attraction.

This is followed by using skills assessments in the recruitment process (40%), training hiring managers to conduct interviews focused on competency (34%) and adjusting screening criteria to diversify and expand talent pools (34%).

As a result of adopting skills-based methods, companies report better talent attraction (39%), finding better fit candidates (35%), better candidate engagement (34%), improvement in diversity (31%), reduced time to hire (29%), reduced hiring costs (23%) and reduced employee turnover (22%).

Almost 1 in 3 businesses also use matching technology to find candidates with the right skills, and 1 in 5 have removed degree requirements from their job adverts. Despite the majority (58%) saying that current education and training programs aren’t adequately preparing candidates for the roles they need to fill, degree requirements are still highlighted in most job adverts.

Therefore, employers should review their requirements and consider focusing on skills and competencies candidates have regardless of their degree, university or grade (depending on the role) – especially to improve the diversity of their talent pool.

Totaljobs – Your hiring solution partner

Work with an industry-leading hiring solutions provider that understands your challenges and can help you find the skilled talent you need. Part of the global recruitment technology company, The Stepstone Group, Totaljobs is a cutting-edge recruitment solutions partner whose goal is to find the right job for everyone. Find the right people for your business by reaching wider talent pools, increasing your brand’s visibility, and maximising your hiring budget.

About the research

All figures, unless otherwise stated, are from a survey conducted with Opinium Research. Total sample size was 1,000 HR decision-makers. Fieldwork was undertaken between 19th – 28th of March 2024. The survey was carried out online.

As we work to improve our findings and insights, we recruited a new panel of HR decision makers representing different industries and business sizes. We have also updated one of our recurring questions around the average time to hire*, specifying this period from ‘advertising a role’ to ‘filling a role’.