UK wages play catch up with the inflation

The most recent ONS estimates of labour market data (13th June 2023) show that wage growth picked up in April 2023. This is set to make the Bank of England’s plans to halve inflation more difficult, making another raise in interest rates likely. The market is still tight; therefore, redundancies and unemployment in the UK remain low. Meanwhile, long-term sickness is at an all-time high.

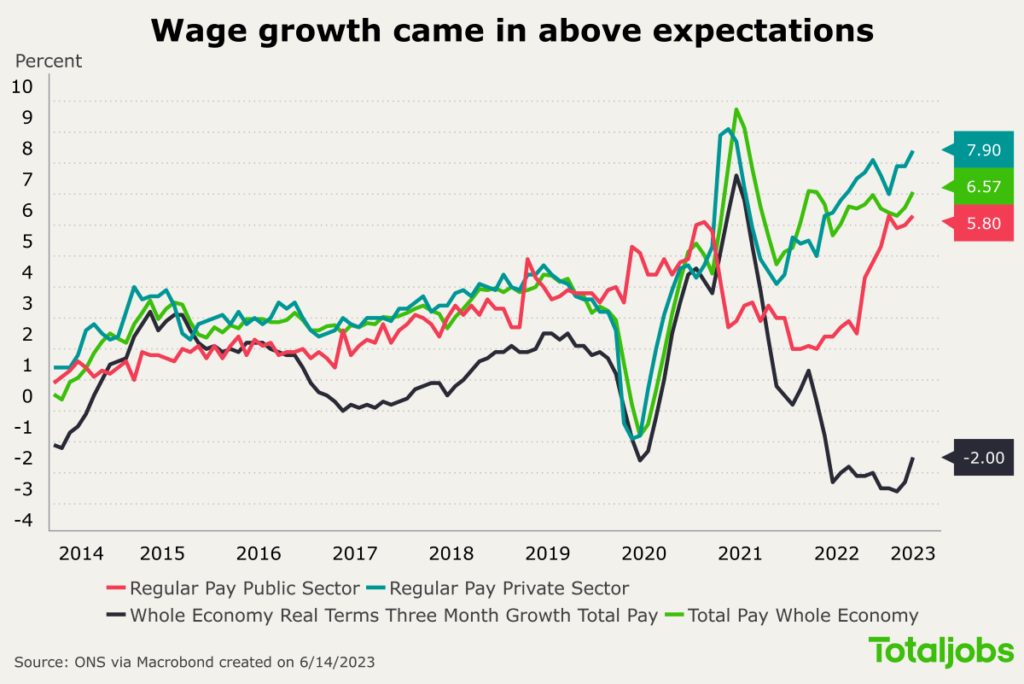

UK wage growth reached a historic high at 7.2% in April, closing in on the current consumer price inflation rate (8.7%). This was partly influenced by the increase in national living wage. The minimum wage rose to £10.42 an hour for those aged 23 and over.

Despite wage growth, inflation-adjusted pay fell by 1.3% in the three months to April. The biggest gains were seen in business and finance services sectors, which means wage growth isn’t proportionally divided between professions or industries. As more people become affected by rising interest rates and ongoing inflation, the demand for salary increases is unlikely to subside.

Positively, the labour market looks strong as the employment rate increased while the unemployment rate decreased in the past three months. Additionally, the UK’s GDP also showed 0.2 percent growth in April 2023.

Key findings from the ONS data

- The labour market continued to grow in the past three months as the employment rate increased and the unemployment rate decreased, to 76% and 3.8% respectively.

- Both employment levels and working hours were up, catching up with pre-pandemic levels.

- The estimated number of payroll employees for May 2023 shows a monthly increase, up to 30 million. Last month’s estimates had shown a significant decrease in payrolled employees, which the recent estimates revised.

- UK wage growth hiked up to 7.2%, making it very likely for the Bank of England to raise interest rates for the thirteenth time, from the current rate of 4.5%.

- The estimated number of vacancies fell for the eleventh consecutive period but remain above pre-pandemic levels at 1,051,000.

- The number of people out of work due to long-term sickness continued to rise, setting a new record at 2.55 million.

Despite more joiners to the workforce, the job market remains tight

The UK labour market appears strong, as employment has gone up and redundancies remain at record low levels. Although the number of vacancies has been falling, employment is unlikely to slow down due to ‘labour hoarding’.

Employers are hanging on to their staff, as labour and skills shortages jeopardise business growth. Labour shortages are also driving salaries up, as seen in the hospitality sector most recently. Economic inactivity continues to decrease as well, but the number of people who are inactive due to long-term sickness rose to a new record at 2.55 million. This is also tightening the labour market.

Most returners to the labour market in the last few months have been early retirees and students.

Inflation is affecting each worker differently

According to the ‘cost of living insights’ by ONS, around 4 in 10 adults are finding it difficult to afford rent or mortgage payments. Economic pressures are playing into the hands of workers in industries where labour and skill shortages are most prominent. According to the latest reports, total pay – including bonuses – increased by 6.5% in the most recent period.

However, not all workers are receiving a pay increase. So, the cost of living remains a pressing issue for the public. When pay rises are not possible for businesses, there are still a number of things employers can do to support staff.

For example, our salary and benefits research found that new benefits such as household bill support were on the rise. The cost of living is also making 2 in 3 workers consider relocating to another city.

European Labour Economist Julius Probst comments

The tight labour market is generating large wage gains, especially in the private sector. Nominal wage growth exceeded expectations again and is close to 7% as workers are trying to gain back some lost purchasing power. Current wage growth is far too high for the BoE’s liking though and inconsistent with the 2% inflation target. The pound therefore appreciated as financial markets are now expecting more rate hikes to come. The BoE will continue to tighten monetary policy this year as the British economy is edging closer to a wage-price spiral scenario.

However, one should keep in mind that real wage growth is actually still negative, given that inflation is running at above 9%. This is especially true for public sector employees, who have seen smaller wage gains over the last few years. As the cost-of-living crisis continues, the number of days lost to strikes has reached a new record high of 3.8 million, a number not seen since 1990 during the Thatcher government.

Finally, redundancies in the UK remain historically low amidst a still very tight labour market.

Julius ProbstEuropean Labour Economist

Totaljobs’ overview of the recruitment landscape

Our latest Hiring Trends Index provides an understanding of the revised economic outlook of the UK and how it impacts recruitment, while looking at skills and labour shortages as a primary hiring challenge for employers in 2023.

According to our data;

- 35% of businesses increased recruitment in Q1 compared to 30% in Q4.

- More than a third (37%) of HR leaders say labour/skills shortages is their top hiring challenge, which has replaced offering salaries in line or higher than inflation (34%).

- Majority of businesses are facing this challenge. Businesses are upskilling existing staff (35%), offering increased salaries and bonuses (29%), providing more flexible work arrangements (25%) or increased staff benefits (19%) and hiring entry-level talent (18%).

- One third (33%) of resignations in the past three months were driven by employees seeking a higher pay.

- Only 34% of businesses advertise specific salary and bonus information, which may be hindering their efforts to attract talent.

- The average mean time to hire stands still at 6.4 weeks, which is an improvement from 2022. However, it is still higher than the average time to hire in 2021.

Totaljobs’ Hiring Trends Index provides a quarterly view of the UK job market and the recruitment trends shaping it. In this edition, we look at the first quarter of 2023 to understand how employers are navigating the ongoing challenges related to the economy, and labour and skills shortages.

- Read our Hiring Trends Index to learn more about how economic factors are influencing the labour market and what employers are doing to attract and retain workers.