Hiring Trends Index: a look at the recruitment landscape of Q3 2022

Totaljobs’ Hiring Trends Index Is a quarterly deep-dive into the recruitment trends that are impacting UK businesses, workers and jobseekers, and gives employers a first look into how the current climate will shape business. This edition looks back at Q3 2022, and ahead to Q4 2022 and 2023, highlighting the current economy and career decisions of over 50’s.

The Q3 2022 edition takes an in-depth look at insights from 1,074 HR experts, and what 4,582 UK workers views are about the current job market with a specific focus on over 50’s and their feelings towards the rising cost of living and retirement.

Hiring trends Index – key findings at a glance

As the economy declines, shrinking by 0.6% in June 2022, the cost of living continues to impact all demographic groups, affecting UK workers career decisions.

An unprecedented number of people aged 50-64 have moved out of work since the beginning of the pandemic and the ‘economically inactive’ has risen by 228,000. This rise has been larger for people in their 50’s and 60’s than any other age group. According to the ONS Over 50’s will soon account for almost three quarters of the UK’s economic inactivity. In fact, 6 in 10 (63%) adults aged 60-70 said they left work sooner than expected which is proving to be a concern for the economy alongside labour shortages and soaring vacancies.

Top takeaways from the hiring trends index Q3 2022

- The unemployment rate decreased to 3.6%, the lowest rate since 1974 (when records began), however vacancies are on the decline, as the number of payrolled employees rose by 718,000 since February.

- A third (35%) of businesses increased recruitment in Q3, down from 41% in Q2

- 1 in 10 (13%) of UK workers are planning to leave their job in the next 6 months

- Over half (52%) of UK workers say receiving a pay rise in line with or higher than inflation would encourage them to stay in their current role.

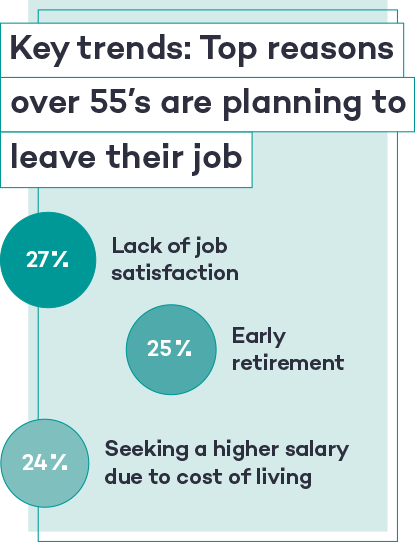

- A quarter of over 55’s that are planning to leave their role are doing so to retire early

- The average mean time to hire has increased slightly to 6.79 weeks

The last three months

Businesses that recruited in Q3 increased to 84% compared to Q2 (79%), however, the amount of businesses that have increased recruitment has dropped from 41% in Q2 to 35% in Q3, only 7% say they have decreased recruitment, and the same amount as Q2 report that they have not hired in the past three months (23%). We also see an increase in those that have paused recruitment in Q3 (16%) compared to Q2 (12%), suggesting that economic uncertainty over the quarter has slowed recruitment growth.

Of the 84% of businesses that recruited in Q3, the industries that are the most likely to have hired in the past three months are Operations (29%), Technology (23%), Sales (19%) and Finance (17%). At the same time, skill shortages within the same industries are expected to have the biggest impact on businesses in Q4 (Technology 25%, Operations 22%, Sales 5%), highlighting that although there is an intention and some successes to hire in these sectors, employers are struggling to recruit the calibre of staff they need.

The challenge employers face with struggling to find the right people for the role is exacerbated when hiring time is considered. The average mean time to hire is 6.79 weeks, which is relatively high, and a slight increase since Q2 (6.76 weeks). This seems to be concerning employers for the future as well, 17% say lengthy time to hire is a key challenge for them in Q4 and 2023.

Similarly to last year, the total hours worked remains high. Only 9% saw a reduction in the total hours worked in Q3, and almost a fifth (18%) saw an increase, displaying the burden high vacancies have on staff.

There has been a slight increase when it comes to restructuring teams in Q3 (22%) compared to Q2 (19%), perhaps showing that some employers are taking other methods, outside of recruitment, to fill gaps within their business.

| Percentage of firms which increased recruitment between July-September 2022 | |

|---|---|

| Media/marketing/advertising/PR & sales | 47% |

| Education | 45% |

| Real estate | 42% |

| Medical & health services | 41% |

| Transportation & distribution | 41% |

| IT & telecoms | 36% |

| Construction | 36% |

| Legal* | 36% |

| Manufacturing | 33% |

| Finance & Accounting | 33% |

| Hospitality & Leisure | 32% |

| Retail | 30% |

Recruitment in Q4 2022

Over the next three months, over a quarter (26%) of businesses intend to increase recruitment in Q4, which has dropped from 31% since Q2. During the same period, almost a quarter (23%) of businesses intend to increase recruitment spend for specialist roles, demonstrating that as skill shortages remain, vacancies for specialist staff is a priority. In fact, non-specialist recruitment is planning to go down to 9% (12% in Q2).

Recruitment is a primary issue for businesses in Q4 and 2023, however the current economy is proving to be a concern over the upcoming months also. The cost of living is the biggest concern for employers (55%) as well as the effect the cost of living will have on business cost (50%), followed by retaining staff (26%), skill shortages and labour shortages (both 23%), lack of business growth (18%) inability to offer competitive salaries (17%), lengthy hiring times (17%) not being able to recruit as much as the business wants to (16%) and the lack of job applications (14%). Businesses also have concerns when it comes to their employees and candidates, namely around supporting the mental health of staff (14%), older workers retiring and leaving a skills gap (13%), managing flexible working patterns (12%), the inability to meet customer demand, UK immigration rules limiting international talent pools and attracting entry level talent (all 11%). These have dropped slightly since Q2 though, indicating the impact the rising cost of living is having on hiring new staff and supporting their current workforce.

Some elements of recruitment intend to stay the same, only 10% of businesses are planning on taking steps to making their talent pools more diverse and only 5% expect to introduce a new hiring model, which has both not changed from the expectation in Q2. This could point to a key reason as to why some employers may be struggling to hire the people they need.

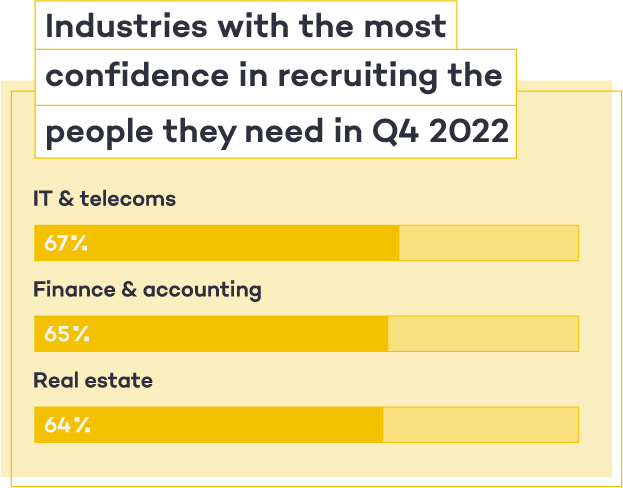

Positively, over half of employers (53%) are confident they will hire the people they need in Q4, which has increased from 50% last quarter, with the most confidence in IT & Telecoms (67%), Finance & Accounting (65%) and Real Estate (64%).

Rising cost of living

Looking to the future, the rising cost of living remains at the top of the list of challenges for employers and staff alike. In fact, half of businesses expect the rising cost of living to impact their overheads in Q4 and into 2023. Along with the practical challenges the cost of living has on businesses, it also seems to be affecting their ability to retain staff.

This becomes apparent when taking into consideration the views of employees. 13% of staff are considering leaving their current role and 19% are undecided, the main reason for this leans heavily on the impact of accelerated living costs. 43% of those that are planning to leave their role say they are seeking a higher salary due to the cost of living, this is up from 37% in March (21% are seeking a career change, 12% are seeking greater flexible working opportunities and 10% are retiring).

When asked what would encourage them to stay, staff make it clear that they want higher salaries to meet their rising costs. Over half (52%) say a pay rise in line with or higher than inflation would encourage them to stay, but employers are struggling with this, 17% of businesses say a barrier they’ll face next year is the inability to offer competitive salaries. Not all employees looking to leave require a long term fix though, 20% said a one-off cost-of living bonus would encourage them to stay in their role. This short-term incentive could act as a solution for businesses that are struggling to offer higher salaries long-term.

Retaining staff over 50

With vacancies still remaining high, and staff feeling the effects of a pressured workforce, employees over 50 are deciding whether they should be opting to retire early.

More than 1 in 10 (13%) of employers say older workers retiring and leaving a skills gap is a key challenge for them. This is proven when considering views of staff over 50, as a quarter of over 55’s say they are considering leaving their role to retire early. Interestingly though, the main reason over 55’s are planning to leave their current role is due to a lack of job satisfaction (27%), and a quarter say they’re seeking a higher salary due to the cost of living.

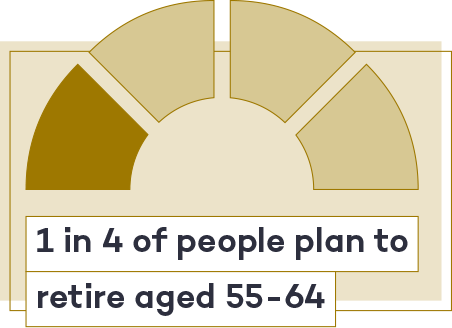

This could prove to be a challenge in the future as well, a quarter (24%) of UK workers say they expect to retire between ages 55-64, which is generally younger than the national average – that usually sits around 65.

On the other side of the coin, some staff over 50 are struggling to predict when they are able to retire. 3 in 10 over 55’s say they are more concerned than they have ever been about having enough money for retirement and 22% say they are delaying retirement due to the rising cost of living.

Despite employers taking note that retirement is having an effect on their workforce, 34% admit that they’re not currently offering any specific benefits or wellbeing initiatives to retain staff over 50. However, 21% say they offered support to help their staff plan for retirement, 19% have offered a pay rise inline or higher than inflation, and 16% improved flexible working options.

Totaljobs CEO, Jon Wilson, comments on the Hiring Trends Index Q3

The latest data highlights that while skills shortages remain a concern, these concerns have eased ever so slightly. However, the market is by no means steady and businesses would do well to plan ahead.

Businesses need to look at the wider context if they are hiring over 50s, or have a large proportion in their workforce. For example, it’s vital to set up facilities by which these workers can share their knowledge and experience with the younger workforce to ensure that knowledge is shared across the business.

The skills shortage is still a pressing issue, so thinking about transferrable skills across the organisation will also be vital.

Jon WilsonCEO at Totaljobs

Attract, hire and retain staff with product solutions

Totaljobs don’t just post roles; we can support the end-to-end hiring process of businesses looking for the next member of their team.

Employer Branding with Universum- tell your unique brand story

For employees over 50, the rising cost of living is a contributing factor when deciding whether to move to a new role or retire early, however, salary is not the only contributor when making this decision. Workers aged over 55 that are considering leaving their job say the feeling of being over worked (21%) and a lack of job satisfaction (27%) are key motivators for them to leave. Despite this, over a third of employers (34%) currently aren’t offering any specific wellbeing options or benefits to target workers over the age of 50 and relieve some of that pressure. Consider how your own employer branding could reflect an age-diverse workforce to attract experienced talent.

With a record number of job vacancies, candidates have their pick of the market. Employers looking to better understand how potential candidates perceive their EVP can work with employer branding experts, Universum, to craft content and creatives that tell stories that resonate with diverse talent externally and highlight what it means to work for them.

Global Hiring – extend your reach

Half of employers are planning to hire from overseas in the next year, however many are still facing a variety of challenges that complicate the process. In fact, a fifth of employers will avoid hiring from overseas simply because it’s too difficult.

That’s why Totaljobs’ Global Hiring is built to keep things straightforward, whether you’re a UK based employer looking to attract candidates from overseas to relocate, or you want to hire remote workers based across the world.

For larger employers hiring in multiple locations, keep things simple with one account manager who speaks your local language and works in your time zone, so you can recruit the people you need, wherever you need them, through the world’s largest alliance of market leading job platforms.

Appcast Xcelerate - optimise recruitment with a Pay-Per-Application model

With average time to hire sitting at over 6 weeks, employers who need to hire in large volumes want to optimise their recruitment, while sticking to budget.

Appcast Xcelerate uses programmatic technology to offer breadth and efficiency of advertising across a variety of job platforms and utilises a Pay-Per-Application model. This means that even in today’s tight market where competition for talent is fierce, you can fill high volume roles quickly, with no budget wasted.

HR decision maker’s sample

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,074 adults. Fieldwork was undertaken between 15th – 30th September 2022. The survey was carried out online. The figures have been weighted and are representative of British business size.

UK workers sample

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 4,528 adults. Fieldwork was undertaken between 20th – 21st September 2022. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).