Hiring Trends Index: a look at the recruitment landscape of Q4 2022

Table of Contents

- Key findings at a glance

- Top takeaways

- The last three months

- Recruitment in Q1 2023

- The impact of cost of living on jobseekers

- Retaining and supporting staff

Totaljobs Hiring Trends Index provides a quarterly view of the UK job market and the recruitment trends shaping it. In this edition, we look back at the final quarter of 2022 to understand how economic factors such as the cost of living are impacting UK businesses, workers, and jobseekers. Additionally, we draw on insights from HR decision-makers to predict the 2023 recruitment landscape.

Hiring Trends Index – key findings at a glance

Over the past few months, the rising inflation and fall in GDP have sparked concerns about a recession in the UK. In his Autumn Statement, Chancellor Jeremy Hunt confirmed these concerns based on projections from the Office for Budget Responsibility.

In the coming months, businesses are expected to tighten their belts and cut costs. However, this recession is expected to be unlike its predecessors. This means it’s unlikely to lead to pay freezes or mass redundancies across a multitude of industries.

Businesses need their people more than ever, and the OBR predicts that the unemployment rate will peak at 4.9% in 2024 (compared to 8.4% in 2008). Meanwhile, the rising cost of living remains a pressing issue for jobseekers and puts a higher salary on top of candidate priorities.

Over half (57%) of the respondents who are looking for a new job in 2023 said they are seeking a higher salary to counteract the rising cost of living. However, ‘January job rush’ is slower than usual, as one in three (31%) jobseekers are worried about job security.

Top takeaways from HTI Q4 2022

- The UK unemployment rate largely remained unchanged around 3.7% throughout 2022, despite the falling GDP and recession concerns.

- Less than a third (30%) of businesses increased recruitment in Q4 compared to 35% in Q3.

- In 2023, employers expect inflation’s impact on business costs (41%) and meeting salary expectations (39%) to be their key challenges.

- One third (31%) of employees are planning to look for a new job in 2023, down from 90% in 2021 – pointing to the end of the Great Resignation.

- The pressure of finding the right talent continues to impact business, as more than a quarter (27%) expect filling vacancies will be challenging in 2023.

- The average mean time to hire has slightly decreased in the final quarter of 2022, falling to 6.4 weeks from 6.8 in Q3. This is still higher than the average time to hire in 2021.

- Higher salaries are the top driver behind job searches (57%) in the next 12 months as jobseekers aim to counteract the rising cost of living.

The last three months

78% of businesses recruited in Q4 2022, down from 84% in Q3. Some businesses (16%) have paused their recruitment in the past two quarters as the economy threatens growth plans. Almost a quarter (24%) of businesses didn’t make any changes to their workforce in Q4, another testament to businesses taking stock of the current economic situation.

We also saw businesses resorting to alternative staffing solutions as 12% hired temporary staff, contractors, or freelancers in Q4. Despite the slowdown in recruitment, the number of payrolled employees in the UK peaked at 29.9 million and the record levels of available vacancies persist at 1.18 million.

Similarly to the previous quarter, businesses that recruited in Q4 2022 were most likely to recruit for Operations (25%), Technology/IT (22%), Customer Service (16%), Sales (16%) and Finance (14%). Although skills shortages in these industries are an ongoing concern, there is a positive shift in the labour force as people who previously reported ‘long-term sick’ rejoin the workforce.

According to ONS data, there was a slight increase in the number of redundancies in the last quarter of 2022, although still at a record low (3.1%). News about redundancies continue to make headlines most notably in the technology sector. However, it’s unlikely for candidates to remain unemployed for an extended period due to the skills and labour shortages in the industry. On average, only 5% of businesses said they were planning to make redundancies in the first quarter of 2023.

Since the UK labour market remained tight in the past quarters, employers spent 6.4 weeks looking for the talent they need. This is two weeks longer on average than the time to hire in 2021. Consequently, 17% of businesses say lengthy time to hire is a concern in 2023.

Despite a slowdown in recruitment, the total hours worked increased by 20% on average across all industries – indicating more workload for existing staff. As both businesses and employees are after more financial stability, retention comes to the forefront for employers and competition for specialist roles is set to heat up.

Recruitment in Q1 2023

As most businesses reviewed their overhead costs and planned for 2023, over a quarter (28%) of businesses said they intend to increase recruitment in Q1. Positively, employer confidence in meeting hiring needs remained steady.

Majority of employers (53%) think they will find the talent they need in 2023, with the most confidence in recruiting for Finance & Accounting (64%), Real Estate (64%) and Media/Marketing/Advertising/PR & Sales (61%) roles.

Of those who plan to hire, 17% say they will increase recruitment spending for specialist roles compared to an 8% increase for non-specialist hires. More than one in ten (13%) said they will also increase hiring for temporary, freelance or contract roles.

The slowdown in economy will hit each industry differently, but most businesses expect similar challenges in 2023.

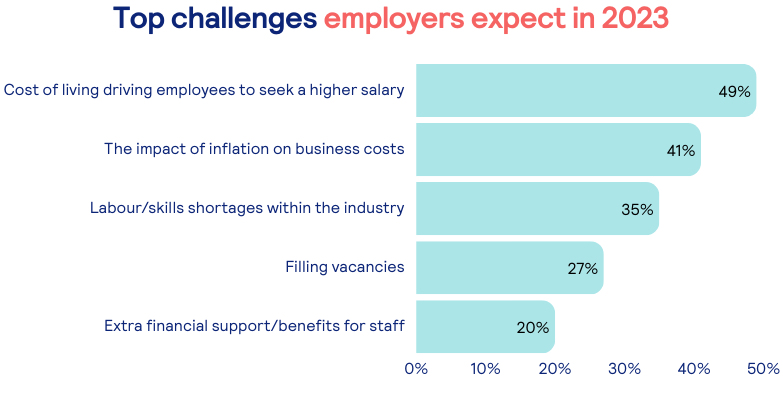

The impact of rising cost of living and inflation are the top challenges employers will face in 2023. In close second, businesses cite labour and skills shortages. Since labour shortages are hindering growth plans in some industries, businesses are demanding the government to ease immigration rules. 18% of respondents are concerned about the UK’s immigration rules limiting international talent pools.

Consequently, businesses are struggling to find the right talent and fill vacancies. Although 14% of businesses are worried that the inflation could result in reduced training budgets, businesses should continue to invest in developing talent to increase retention and avoid more skill shortages in the future.

Businesses are also increasingly concerned about supporting their staff around their mental health and wellbeing (18%), as well as providing additional financial support and/or benefits (20%).

The impact of cost of living on jobseekers

Throughout 2023, the inflation and accompanying rising cost of living will continue squeezing salaries and challenging businesses. In Q4 2022, more than two fifths (43%) of employees who resigned left their jobs for a higher salary.

However, jobseekers are less likely to move jobs compared to 2021. Only one in three (31%) said they are looking for a new job in the new year.

For more than half of them (57%), the motivation behind their job search is attaining a higher salary. Therefore, 62% of jobseekers expect employers to disclose the salary information to entice them into applying.

Despite the fewer number of jobseekers, the number of applications per vacancy is set to increase as more than half (62%) say they will apply for a higher number of jobs than usual.

Retaining and supporting staff

Considering that one in three (31%) workers are planning to look for a new job in 2023, employers are under pressure to offer pay rises. Positively, almost half of businesses (48%) are prepared to meet this demand in 2023.

In the last quarter of 2022, employers took appropriate actions to retain their staff. Almost half of businesses (49%) provided pay rises either in line or below the inflation rate in the past quarter, over a quarter (26%) of them improved flexible working arrangements and one in five (20%) offered a one-off cost of living bonus.

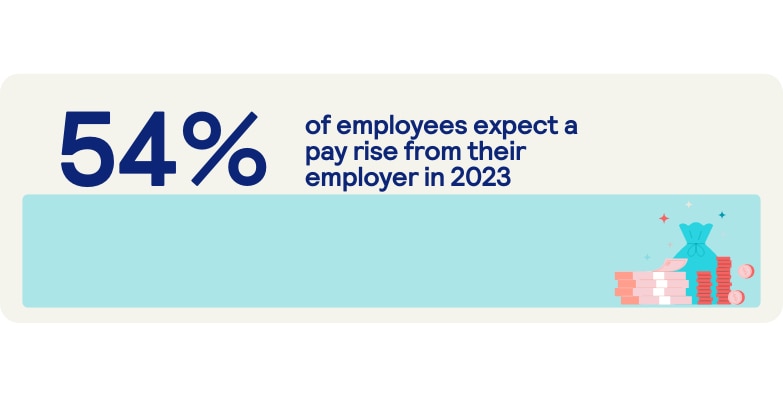

These measures correlate with employee expectations; 54% of employees said they expected a pay rise, 26% want a better work/life balance, and 20% said flexible working hours. Meanwhile, 17% of those who resigned were after a career change, mostly moving on from Education (30%), Legal (29%) and Hospitality (26%) industries.

Our research also shows that some businesses couldn’t meet the demands of their workforce. One in five (21%) said they didn’t take any specific actions to retain or support staff in the past quarter.

European Labour Economist, Julius Probst, comments on the Hiring Trends Index Q4

In a couple of months from now, it will most likely be confirmed that the UK economy has entered a recession – two consecutive quarters of negative growth. If the recession remains relatively shallow, unemployment will not increase as much as the BOE forecast suggests because of labour hoarding.

Companies might implement hiring freezes and recruitment could slow down. However, with the record tight labour market from 2022 and labour shortages due to Brexit, employers should think twice about letting people go since getting them back when the economy picks up again might not be as straightforward as in the past.

Julius Probst, Labour Economist

Totaljobs – Your hiring solution partner

Jobs are our job. As your hiring solution partner, Totaljobs’ products and customer service & success teams are ready to help you tackle your toughest challenges.

We help our customers find new ways to solve old problems, tap into wider talent pools, maximise their hiring budget and hire quicker. Whether you opt for a free solution such as ATS or a cost-effective approach to high-volume hiring with Appcast Accelerate, we support your end-to-end hiring process throughout.

When budgets are tightening and it’s getting harder to attract the talent you need, our solutions make sure your job adverts perform better than ever. We go beyond usual methods to address deeper challenges such as DE&I with Gender Bias Decoder and Equality Boost, while widening your reach. Find the right solution for your business today.

HR decision-maker’s sample

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,000 HR decision-makers. Fieldwork was undertaken between 16th December 2022 – 4th January 2023. The survey was carried out online. The figures have been weighted and are representative of British business size.

UK workers sample

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 4,364 adults. Fieldwork was undertaken between 12th – 14th December 2022. The survey was carried out online. The figures have been weighted and are representative of all UK adults (aged 18+).

Explore articles

Receive the latest recruitment resources and

advice to boost your hiring

By providing us with your details you agree to our privacy policy and for us to keep you updated with the latest news, events,

and special offers from Totaljobs.