UK unemployment goes up, while wages catch up with inflation

Data released by the Office for National Statistics (ONS) in September shows a significant drop in UK employment. Positively, wages have finally caught up with inflation for the first time in 18 months.

The UK labour market has been loosening in the past months as more people are looking for work. This meant an ongoing uptick in the unemployment levels – recently reaching 4.3% – which is now higher than the Bank of England’s prediction for the third quarter of 2023.

On the bright side, UK workers’ wages have been going up despite a slowdown in hiring. Businesses are willing to invest in the talent they need, but vacancies have dropped below a million for the first time since 2021.

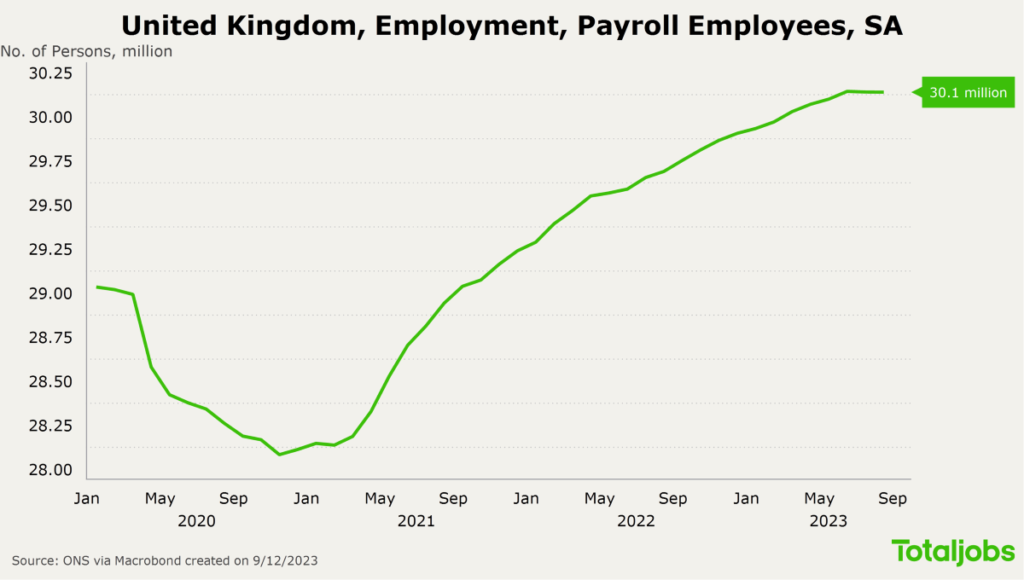

Surprisingly, employment has recently seen its biggest fall since October 2020.

Key findings from the ONS data

- Employment in the UK has significantly dropped in the three months to July, this is the biggest fall in the past 3 years. The employment rate from May to July 2023 was 75.5%, and the decrease was mainly driven by full-time self-employed workers.

- Unemployment continued to rise, reaching 4.3%. ONS data showed more people have remained unemployed for 12 months or longer.

- The number of vacancies has fallen under a million for the first time in two years, in the period from June to August 2023. However, they remain above pre-pandemic levels.

- The economic inactivity rose again, by 0.1 percentage points and it was driven by people aged 16 to 24 years.

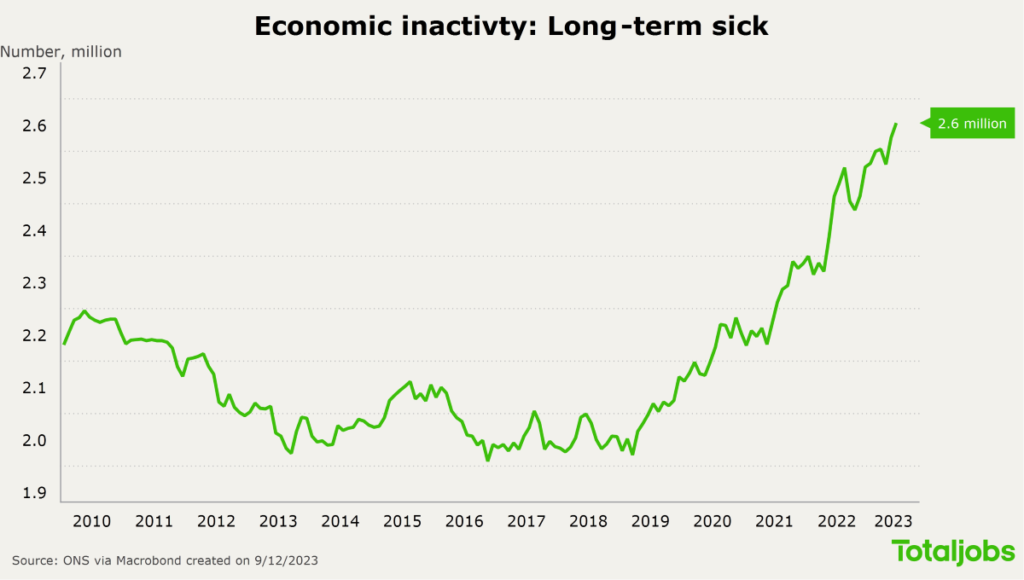

- The number of economically inactive due to long-term sickness also increased to another record – reaching 2.6 million.

- Although more people are looking for work, businesses are spending 5.8 weeks to find the right talent.

The labour market is cooling, but economic inactivity remains a concern

The rise in unemployment and falling number of vacancies point to a cooling labour market.

However, long-term illness is still a concern in the UK, as the number of those economically inactive due to long-term sickness hit a new record of 2.6 million in the three months to July.

The staffing crisis in the NHS and working hours being lost due to strikes increase the already long waiting lists in health services.

Wage growth changes by industry

Wages continued to grow and caught up with the inflation – helped by one-off bonus payments to NHS and Civil Service workers. Annual growth in regular pay (excluding bonuses) was 7.8% in May to July 2023, and the annual growth in employees’ average total pay (including bonuses) was 8.5%. However, adjusted to inflation, regular pay only rose by 0.6%.

ONS reported, “The finance and business services sector saw the largest annual regular growth rate at 9.5%, followed by the manufacturing sector at 8.1%; this is one of the highest annual regular growth rates for the manufacturing sector since comparable records began in 2001.”

Although inflation has been coming down, it’s likely for the Bank of England (BOE) to raise the interest rate next week and keep the interest rates higher for longer.

UK Salary and Benefit Trends: Discover the salary and benefit trends shaping recruitment in your industry in 2023. Compare your offering and find out new ways to attract talent.

UK Quality of Life Index: Find out what your city ranks #1 for and get tips for attracting a new talent pool open to relocation.

European Labour Economist Julius Probst comments

The labour market is clearly loosening. The unemployment rate increased by more than expected in recent months and the number of open vacancies is falling back quickly to pre-pandemic levels. The market is not as tight for those who are hiring, however finding the right talent remains a challenge. With vacancies falling, it’s clear that hiring is slowing down – which means the UK economic outlook is showing signs of weakening. It is possible that the economy will head for a mild recession by the end of this year, which is what most forecasters anticipate. The ongoing struggles in the health sector meant that the number of people who have left the labour force due to long-term sickness just reached another record high and now stands at more than 2.6 million.

Julius ProbstEuropean Labour Economist

Totaljobs’ overview of the recruitment landscape

Our latest Hiring Trends Index takes an in-depth look into the economic outlook of the UK with a special focus on the much-discussed topic of AI. This edition provides an understanding of AI’s integration into recruitment and workforce.

According to our data;

- More than a third (34%) of businesses increased recruitment in the second quarter of 2023.

- 57% of businesses are confident they will recruit the people they need in Q3 2023 – which is consistent with Q1 2023 and rising from 53% reported in Q4 2022.

- Businesses have started to implement AI tools to automate processes. The most popular departments where AI is used include; Technology/IT (23%), Operations (11%) and PR and marketing (10%).

- 2 in 5 (40%) businesses also report using AI in the recruitment process to source (11%) or screen candidates (12%), schedule interviews (11%), create job adverts (11%) and interview questions (10%).

- As the labour market loosens a little, the average mean time to hire decreased to 5.8 weeks from 6.4 weeks.

Totaljobs’ Hiring Trends Index gives employers a first look of the latest quarter of the UK labour market, and the recruitment trends shaping it. In this edition, we look at the second quarter of 2023 with a focus on how businesses are integrating AI in the recruitment process and the workplace.

- Read our Hiring Trends Index to learn more about how AI is helping recruiters streamline their hiring process and what businesses are planning when it comes to hiring and their workforce.